Home / Business and Economy / AMD's AI GPU Surge: $100B OpenAI Deal Looms

AMD's AI GPU Surge: $100B OpenAI Deal Looms

21 Jan

Summary

- AMD's AI GPU revenue is projected to climb 30% in 2025.

- A 6GW agreement with OpenAI could yield over $100 billion.

- Analyst initiates coverage with a Neutral rating and $230 target.

Advanced Micro Devices (AMD) is increasingly competitive in the AI GPU sector, with its MI3xx platform seeing broader adoption by U.S. hyperscalers.

The company's AI GPU revenue is forecasted to increase by approximately 30% in 2025, driven by expanded usage from major clients like Meta, Microsoft, and xAI.

Analyst Srini Pajjuri anticipates AMD's GPU revenue will double in 2026, with a key inflection point expected in Q4 as OpenAI begins utilizing MI450-based systems.

Pajjuri highlights AMD's solid roadmaps for GPUs and systems, alongside maturing software and an extensive customer base, suggesting a potential long-term market share of 10-20%.

A notable 6GW agreement with OpenAI presents a significant opportunity, potentially worth over $100 billion by 2030. AMD management has indicated strong visibility for an initial 1GW deployment commencing in Q4 2026.

However, challenges such as power and data center infrastructure availability could affect the pace and scale of AMD's opportunity with OpenAI, which has also made substantial commitments to NVIDIA and Broadcom.

Concurrently, AMD is expected to continue its market share expansion in servers, holding around 40% currently, bolstered by an x86 refresh cycle driven by AI adoption.

Pajjuri has initiated coverage on AMD stock with a Neutral rating and a $230 price target, citing a premium valuation of 32x 2026E P/E, which he believes already accounts for the anticipated OpenAI opportunity.

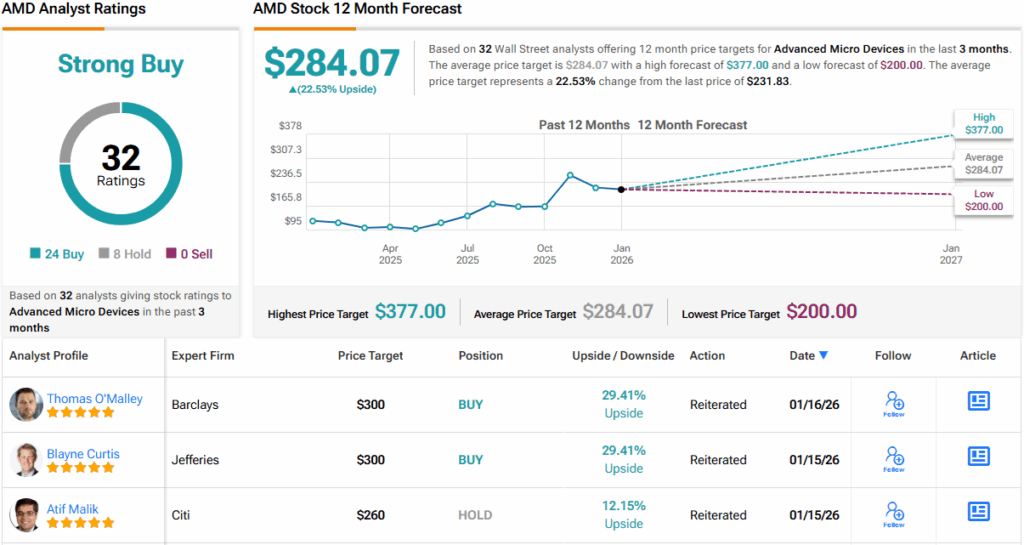

Despite Pajjuri's neutral stance, the broader analyst consensus for AMD stock is a Strong Buy, with an average target price of $284.07.