Home / Business and Economy / AMD Eyes China AI Chip Market Re-Entry

AMD Eyes China AI Chip Market Re-Entry

9 Dec, 2025

Summary

- US to approve Nvidia H200 AI chip sales to China.

- AMD's MI300 AI processors face export rule limitations.

- Potential 25% revenue-share deal for AMD in China.

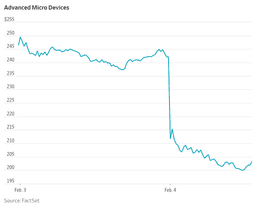

Advanced Micro Devices (AMD) experienced a minor stock uptick early Tuesday following indications that the U.S. might approve Nvidia's H200 AI chip sales to China. This potential policy adjustment involves a 25% revenue-share arrangement, a development that could have direct implications for AMD's market access.

While AMD's high-demand MI300 AI processors have been globally sought after, their access to the Chinese market has been restricted by tighter U.S. export regulations. Should Washington extend similar approvals to AMD, the company could resume sales to Chinese cloud and AI firms, potentially tapping into a substantial revenue source.

Analysts suggest AMD's Instinct chips could serve as a complementary option alongside Nvidia's hardware in China's diverse AI chip market. Investors appear to be prioritizing market access over immediate profit margins, with AMD's 2026 outlook anticipating broader MI300 adoption and stronger global cloud partnerships.