Home / Business and Economy / Alibaba Surges on AI Hopes and Strong Earnings

Alibaba Surges on AI Hopes and Strong Earnings

25 Nov

Summary

- Alibaba stock has surged over 83% year-to-date.

- Analysts anticipate strong Q2 earnings and revenue growth.

- AI and cloud services are significant drivers of investor sentiment.

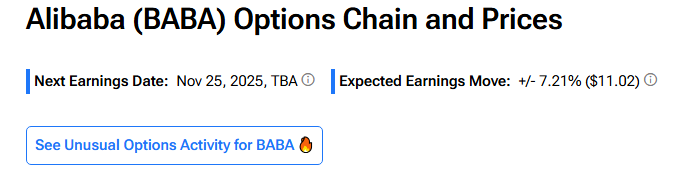

Chinese e-commerce leader Alibaba is poised to report its Q2 FY26 earnings on November 25th, following an impressive year-to-date stock performance of over 83%. This significant rally is attributed to robust financials and enhanced profitability within its primary e-commerce operations. Investor sentiment is further uplifted by the increasing demand for its advanced AI and cloud services.

Wall Street analysts project solid results for the second quarter, with anticipated earnings per share of $0.85 and revenues around $34.30 billion, marking a notable year-over-year increase. Analysts like Wei Fang of Mizuho Securities express strong optimism, raising price targets and maintaining a Buy rating due to observed improvements in core commerce, including order activity and customer spending, alongside steady progress in the cloud division.

The company's strategic focus on AI is a key factor, with rising demand from various sectors, including banking and enterprise clients. Citi also maintains a constructive outlook, reiterating a Buy rating and a substantial price target, anticipating continued execution and positive sentiment as results highlight progress across commerce, cloud, and AI initiatives. Options traders are expecting a significant stock movement of approximately 7.21% post-earnings.