Home / Business and Economy / AI Demand Skyrockets GPU Prices

AI Demand Skyrockets GPU Prices

2 Jan

Summary

- AI data center demand tightens memory chip supply for GPUs.

- Memory module prices surged from $5.50 to over $20 since mid-2025.

- Memory chip makers prioritize higher-margin AI server chips.

Rising demand for AI data centers has created a shortage of memory chips essential for graphics cards, impacting Nvidia's gaming business. The price of a standard 16-gigabit memory module has dramatically increased from approximately $5.50 in mid-2025 to over $20 by late 2025. This surge means memory now constitutes the majority of a GPU's manufacturing cost.

Memory suppliers like Samsung and SK hynix are reallocating production towards more profitable AI server chips, leading to reduced supply for the consumer market. Analysts anticipate further price hikes, with memory prices projected to rise over 40% by mid-2026 and tight supply expected to persist for years.

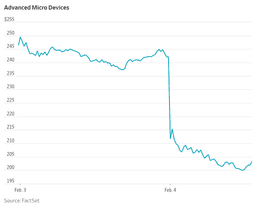

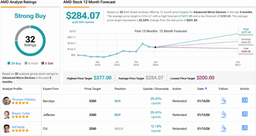

Consequently, Advanced Micro Devices has already increased prices, and Nvidia is anticipated to follow suit in early 2026. While consumers may face higher prices, Nvidia's strategic focus remains on its higher-margin AI products, with its core growth driven by AI infrastructure spending.