Home / Health / Medicare Advantage Plans: 3 Million Affected by Market Exits

Medicare Advantage Plans: 3 Million Affected by Market Exits

18 Feb

Summary

- Nearly 3 million Medicare Advantage members lost coverage due to insurer exits.

- Rural enrollees experienced plan disruptions at twice the urban rate.

- Seven states saw over 40% of Medicare Advantage enrollees affected.

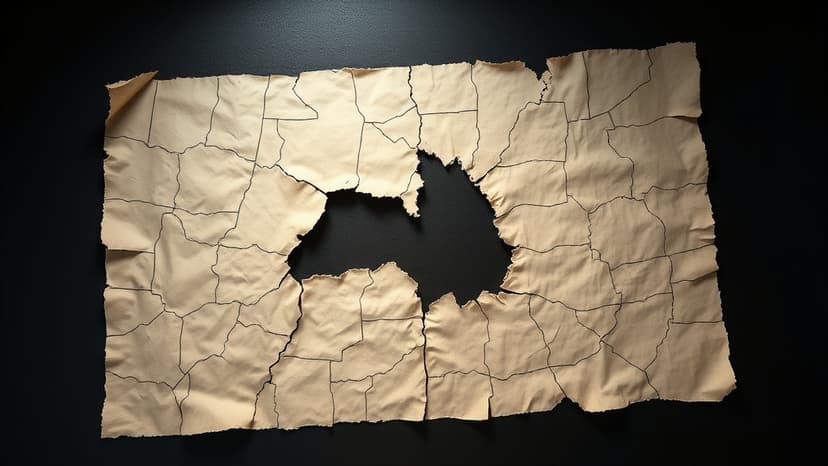

As of 2026, approximately 3 million individuals enrolled in Medicare Advantage plans, representing 10% of all enrollees, will need to find alternative coverage. This situation arises from health insurers scaling back their offerings and exiting markets. A recent study published in JAMA reveals that members in rural areas experienced plan disruptions at double the rate of those in urban locations.

This trend has raised concerns about reduced access to healthcare providers and specialized treatments, particularly for rural populations. In seven states, over 40% of Medicare Advantage enrollees faced plan changes, with Vermont seeing 92% of its enrollees impacted. This widespread withdrawal is partly attributed to rising costs and decreased government reimbursement for insurance companies.

Leading insurers like UnitedHealthcare, CVS Health's Aetna, and Elevance are among those shifting their market presence or exiting certain areas. Smaller carriers accounted for half of those experiencing disruptions. The study also noted that plans offering greater provider choice were more frequently terminated. Experts suggest policymakers should re-evaluate the program's design to better align insurer incentives with beneficiary needs.