Home / Business and Economy / Yen May Hit 180 vs. Dollar, Nikkei Eyes 60,000

Yen May Hit 180 vs. Dollar, Nikkei Eyes 60,000

22 Jan

Summary

- Yen could reach 180 against the dollar within three years.

- Nikkei 225 is predicted to surpass 60,000 by year-end.

- Sumitomo Mitsui plans to double JGB holdings.

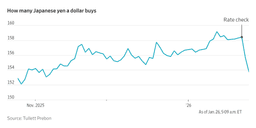

Arihiro Nagata, global markets head at Sumitomo Mitsui Financial Group, predicts a dramatic shift in Japanese financial markets. He forecasts the yen could weaken to 180 against the US dollar within the next three years. Concurrently, he anticipates the Nikkei 225 Stock Average will surge beyond 60,000 by the end of 2026, a substantial increase from current levels.

Nagata also indicated Sumitomo Mitsui's intention to aggressively rebuild its Japanese government bond (JGB) portfolio. The bank plans to potentially double its current ¥10.6 trillion ($67 billion) JGB holdings once current yield volatility subsides. This marks a significant pivot from prioritizing foreign bond investments.

The outlook for Japanese bonds remains cautious due to potential yield increases linked to fiscal policies. However, JGBs are expected to form the core of Sumitomo Mitsui Banking Corp.'s securities portfolio, which currently holds approximately ¥12 trillion in foreign notes. The average duration of its JGB holdings is a short 1.7 years.

Regarding monetary policy, Nagata suggested the Bank of Japan might implement three interest rate hikes in 2026, exceeding the two widely anticipated by economists. This stance is driven by concerns over a weak yen and potential rate increases by the US Federal Reserve, which could further widen interest rate gaps.