Home / Business and Economy / Paramount Bid Sparks WBD Fireworks

Paramount Bid Sparks WBD Fireworks

10 Dec, 2025

Summary

- Paramount aims for Warner Bros. Discovery in $108 billion bid.

- Netflix has accepted a $82.7 billion deal from Warner Bros. Discovery.

- Industry expert predicts further offers for Warner Bros. Discovery.

Kevin Mayer, co-CEO of Candle Media and a former Disney executive, forecasts escalating bids for Warner Bros. Discovery (WBD). Mayer, instrumental in Disney's $71.3 billion Fox acquisition, stated that Paramount's current offer is unlikely to be its final. He anticipates a "sweetened and perhaps meaningfully sweetened offer" as the process unfolds, suggesting "more fireworks."

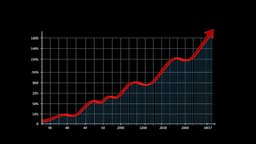

WBD recently accepted a $82.7 billion deal from Netflix, valuing each share at $27.75. However, Paramount Global has since made a hostile bid directly to shareholders for $30 per share, totaling $108 billion. Mayer views the competition as beneficial for WBD, driving up the acquisition price and seeing potential in Paramount's aggressive approach and the Ellison family's financial backing.

Mayer also commented on the broader industry impact, predicting a consolidation with fewer competitors and potentially reduced creative content output. He suggested Netflix's primary interest lies in WBD's studios, seeing strategic value in securing franchises permanently, thus making the acquisition a logical move for content acquisition.