Home / Business and Economy / Wall Street's Digital Future: Stocks Go Blockchain

Wall Street's Digital Future: Stocks Go Blockchain

26 Nov

Summary

- Financial industry is exploring blockchain for instant stock trading.

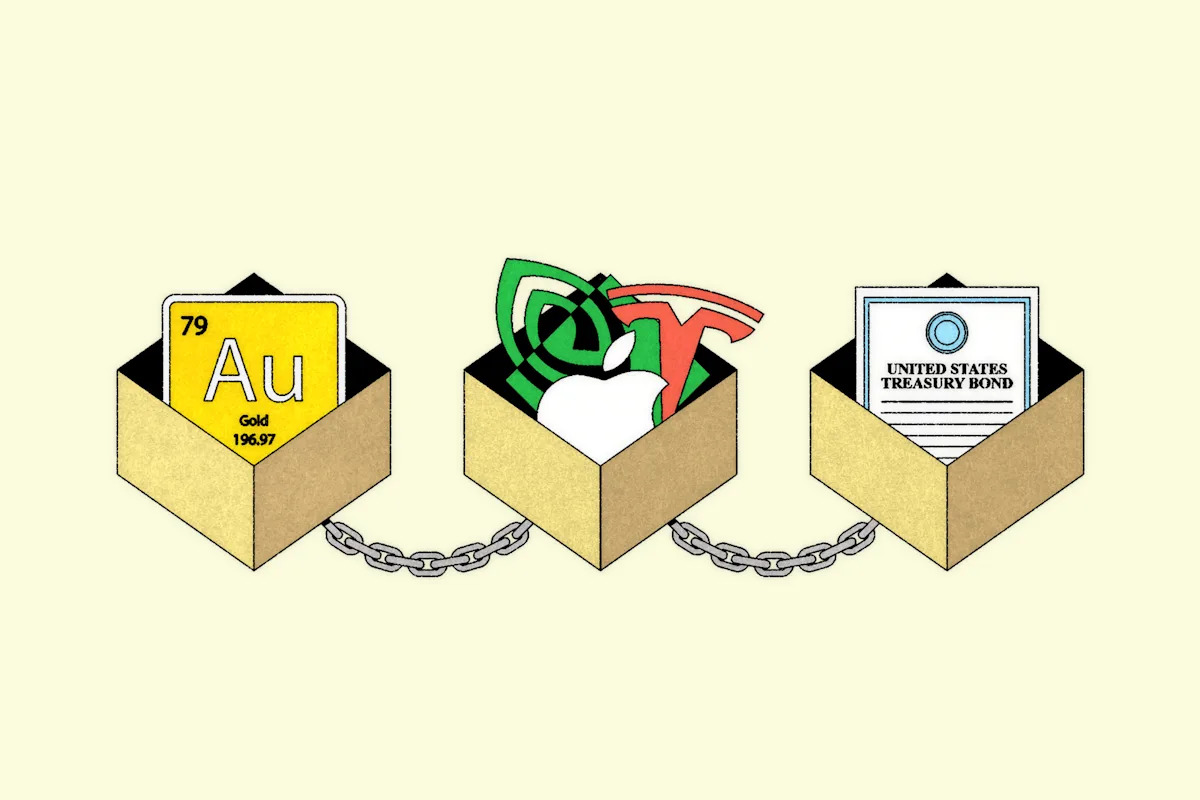

- Tokenization aims to transform asset trading with digital assets.

- Past crises like the 'paperwork crisis' drove previous tech overhauls.

The financial sector is increasingly embracing tokenization, converting traditional stocks into digital assets for instantaneous blockchain-based trading. This innovation aims to address inefficiencies highlighted by past market events, like the 2021 meme stock saga and the 1970s 'paperwork crisis,' both of which spurred significant operational changes.

Big banks like J.P. Morgan are actively involved in using blockchains for asset facilitation, signaling a broad transformation of the financial ecosystem. This digital shift, described by some as a 'freight train,' promises immense benefits, though its implementation poses complex challenges.

Questions persist regarding how tokenization will impact regulatory frameworks and investor protections. While proponents highlight efficiency gains, some experts express apprehension about potential destabilization of the U.S. equities market and the ramifications for individual investors.