Home / Business and Economy / Value Investing Thrives: Fund Beats Market

Value Investing Thrives: Fund Beats Market

4 Jan

Summary

- Fund averages 9% annual dividend and total returns.

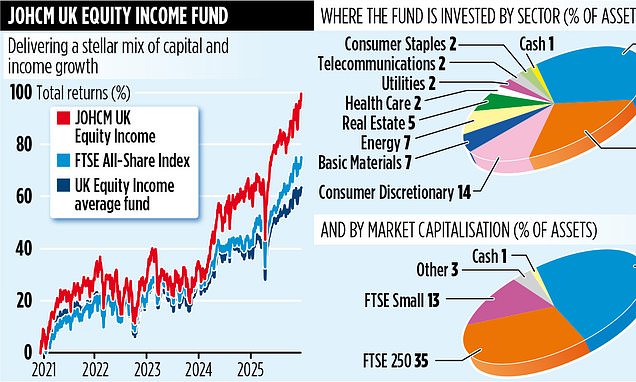

- Achieved 97% total returns over five years, outpacing peers.

- Managers actively seek undervalued UK stocks for growth.

The JOHCM UK Equity Income fund, with £1.9 billion in assets, continues to champion the 'value investing' strategy. Managers Clive Beagles and James Lowen focus on identifying undervalued, dividend-paying UK stocks, a method that has seen sustained success.

Since its inception 22 years ago, the fund has consistently delivered. It boasts average annual dividend growth of 9% and total annual returns exceeding 9%. Over the past five years, its performance reached 97% total returns, significantly outperforming the UK equity income peer group average of 61% and the FTSE All-Share Index's 74%.

Despite market shifts favoring 'growth investing,' Beagles and Lowen remain committed. They highlight that UK stocks, especially smaller and medium-sized domestic businesses, still offer considerable value. The fund's annual charges are a reasonable 0.67%, with dividends paid quarterly, making it an attractive option for income seekers.