Home / Business and Economy / Harvard Expert: Painful Austerity Ahead for US

Harvard Expert: Painful Austerity Ahead for US

7 Dec

Summary

- US debt nearing record levels, exceeding $11 billion weekly.

- Faster growth and low rates unlikely to fix US debt.

- Severe fiscal austerity, cutting defense or discretionary spending, is probable.

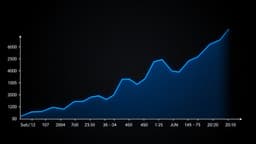

The United States faces an unsustainable trajectory of increasing debt, with publicly held debt already at 99% of GDP and on course to reach 107% by 2029, surpassing post-World War II records. Debt servicing alone now consumes over $11 billion weekly, representing 15% of current federal expenditures.

Experts like Jeffrey Frankel, a Harvard professor, have analyzed various debt reduction scenarios, dismissing faster economic growth and lower interest rates as unlikely saviors. Inflation and default are also considered highly detrimental or implausible. Frankel's analysis points towards severe fiscal austerity as the most probable, albeit painful, solution.

This austerity could necessitate drastic cuts to either defense spending or nearly all non-defense discretionary outlays. Without proactive reform, a severe fiscal crisis may eventually force a radical adjustment, potentially impacting the US bond market and leading to soaring interest rates if trust in Treasury bonds erodes.