Home / Business and Economy / Top Stocks Beat Market Despite Off Year

Top Stocks Beat Market Despite Off Year

16 Dec, 2025

Summary

- Top stocks outperformed the market by 8 percentage points this year.

- Over three years, the top stock list yielded 235% returns versus 69%.

- Two high-conviction stocks are losing value but expected to rebound.

A strategy of selecting 10 top stocks annually has showcased impressive long-term returns, significantly outperforming the S&P 500. While this year's performance saw an 8-percentage-point beat, the three-year track record reveals a staggering 235% gain compared to the S&P 500's 69%. This performance highlights the resilience of sound investment principles, even when individual stocks experience short-term volatility due to market sentiment or quarterly results.

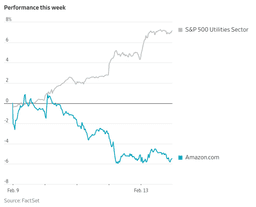

Even the portfolio's two current underperformers are high-conviction picks whose underlying businesses are thriving. This presents a potential buying opportunity for long-term investors, who are encouraged to view dips as chances to increase holdings. The article notes that the S&P 500's recent gains are largely fueled by AI enthusiasm, an area not heavily weighted in this particular stock selection.

Looking ahead to 2026, Amazon is highlighted as a stock with strong growth prospects and AI opportunities, despite current investor concerns about competition and high spending. The author expresses confidence in Amazon's potential for expansion in the coming year, underscoring the strategy's focus on long-term value over short-term market trends.