Home / Business and Economy / TARIL Stock Surges 9% on Q3 Results Anticipation

TARIL Stock Surges 9% on Q3 Results Anticipation

1 Jan

Summary

- TARIL shares jumped nearly 9.27% on January 1, 2026.

- The board meeting to approve Q3 FY26 results is on January 8, 2026.

- The company's Q2 FY26 saw flat revenue and a profit decline.

Transformers & Rectifiers (India) Limited (TARIL) saw its stock price climb nearly 9.27% in early trading on January 1, 2026, reaching an intraday high of Rs. 311.70. This surge was attributed to heightened expectations surrounding the company's upcoming Q3 FY26 financial results. The announcement of a board meeting on January 8, 2026, to review and approve the unaudited standalone and consolidated financial results for the quarter and nine months ended December 31, 2025, has spurred investor interest and speculative trading.

The positive market reaction contrasts with TARIL's performance over the past year, during which the stock has seen a decline of approximately 49.32%. While the Q3 FY26 outlook is optimistic, investors are mindful of the company's Q2 FY26 performance. In the quarter ended September 2025, TARIL reported flat year-on-year revenue of around Rs. 460 crore, and a profit after tax (PAT) decline of nearly 19-20% to Rs. 37-38 crore.

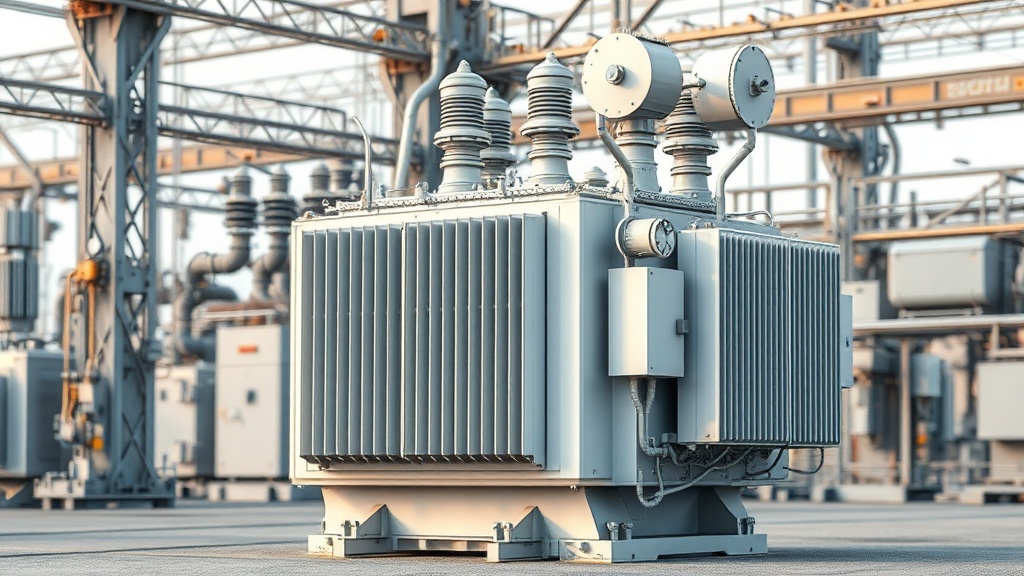

Despite the mixed recent financial performance, the company's disclosure of the trading window reopening on January 11, 2026, has added a layer of transparency. Transformers & Rectifiers (India) Limited, established in 1981 and headquartered in Ahmedabad, Gujarat, is a prominent Indian manufacturer of transformers and reactors, serving diverse sectors including power utilities and railways, and exporting to over 40 countries.