Home / Business and Economy / Strategy May Sell Bitcoin Holdings

Strategy May Sell Bitcoin Holdings

3 Dec, 2025

Summary

- Company CEO stated potential sale under specific conditions.

- Strategy stock value dropped significantly since July.

- Sale would be rational decision for equity shareholders.

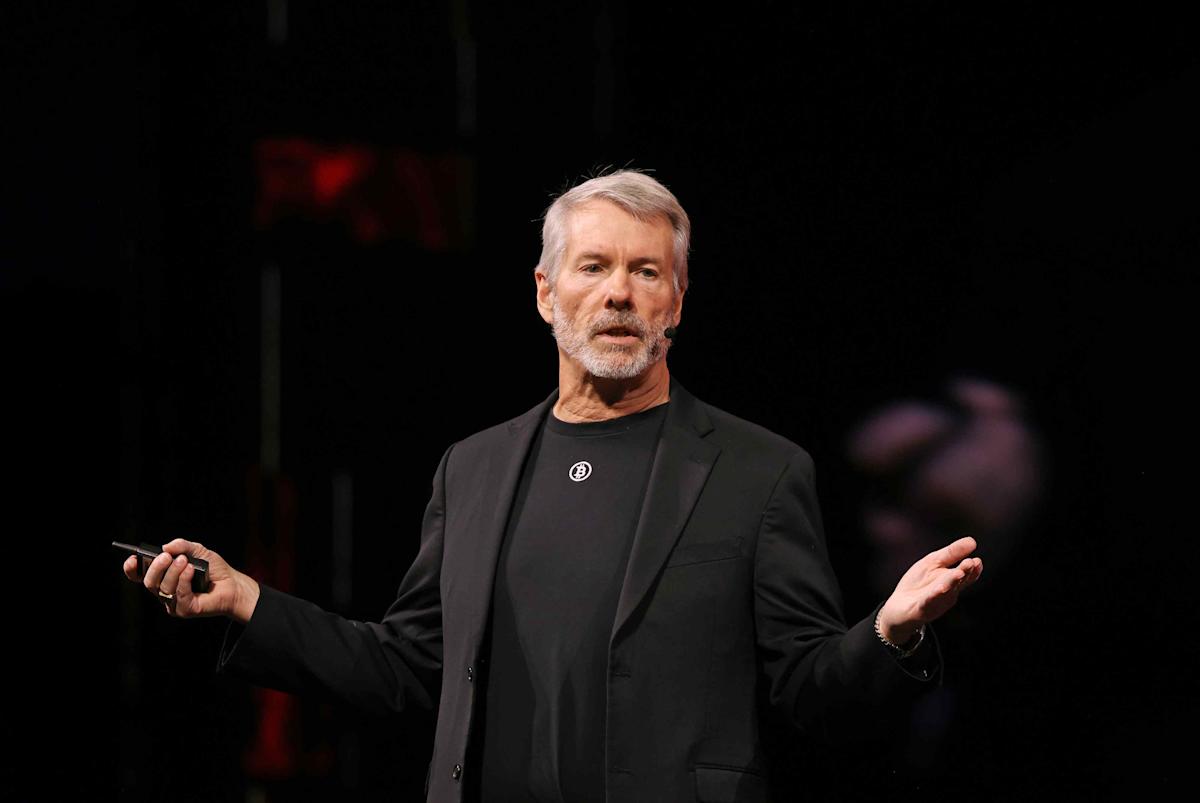

Enterprise software company Strategy (MSTR), widely recognized for its extensive bitcoin treasury, has surprised investors with the possibility of selling its cryptocurrency holdings. CEO Phong Le recently stated that the company would consider selling bitcoin under specific conditions, marking a notable shift from its long-held strategy of indefinite holding. This development occurs amidst a downturn in the crypto market and a significant drop in Strategy's stock value.

Strategy's stock has fallen about 60% from its record high in July. One condition for a potential sale outlined by Le is if the company's stock market capitalization falls below the net asset value of its bitcoin holdings. Currently, Strategy's market cap is approaching this threshold, especially following recent market fluctuations.

Company leadership emphasizes that any decision to sell bitcoin would be a rational choice made in the best interest of equity shareholders. While this potential sale could impact the broader cryptocurrency market, the company maintains it does not signify a lack of commitment to bitcoin but rather a pragmatic approach to financial management.