Home / Business and Economy / SpaceX IPO Could Fund Lunar Factory, Space AI

SpaceX IPO Could Fund Lunar Factory, Space AI

14 Feb

Summary

- SpaceX plans an IPO this year, potentially raising $50 billion.

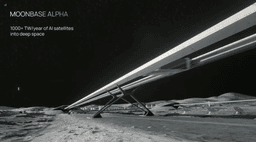

- Funds may support lunar factory and space-based AI data centers.

- A dual-class share structure could give Elon Musk control.

SpaceX is reportedly preparing for an Initial Public Offering (IPO) later this year, a move that could generate as much as $50 billion. The significant capital infusion is intended to fuel ambitious future projects, including the development of AI data centers in space and the construction of a manufacturing facility on the moon.

Central to the IPO discussions is the potential adoption of a dual-class share structure. This strategy, similar to one previously considered for Tesla, would allow select shareholders, notably Elon Musk, to retain substantial control through super-voting shares. This structure aims to preserve founder-led vision and decision-making independence.

The company is also actively expanding its board of directors to help navigate the complexities of the IPO process and further Musk's long-term vision for SpaceX. These plans signal a significant expansion beyond the company's core rocket and satellite operations into advanced areas like artificial intelligence, especially after acquiring Musk's xAI.

While deliberations are ongoing and details may evolve, the prospect of a dual-class share system aims to protect Musk's influence, as he has previously emphasized the importance of maintaining significant voting control for his ventures.