Home / Business and Economy / SoftBank Eyes DigitalBridge in AI Infrastructure Deal

SoftBank Eyes DigitalBridge in AI Infrastructure Deal

6 Dec

Summary

- SoftBank is reportedly in talks to acquire DigitalBridge Group.

- The deal would capitalize on the booming demand for AI infrastructure.

- DigitalBridge shares surged 45% on the news of potential acquisition.

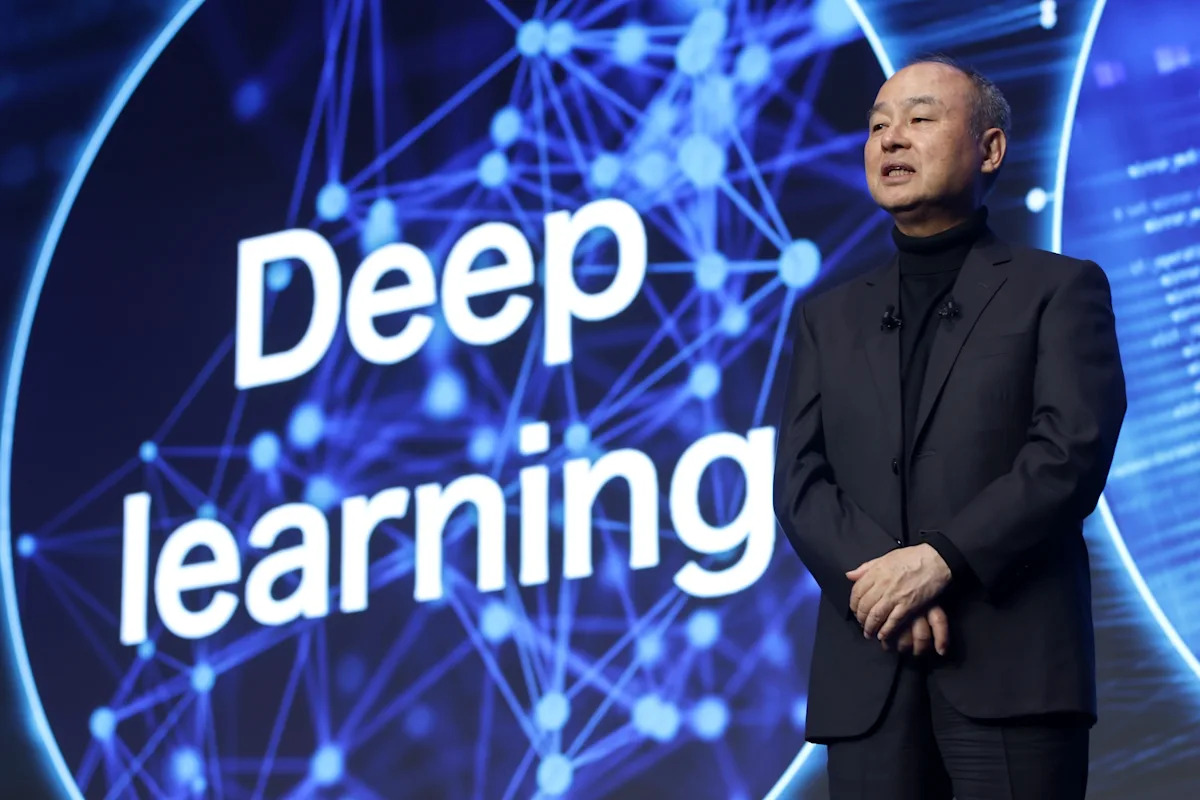

SoftBank Group is reportedly engaged in negotiations to acquire DigitalBridge Group, a prominent private equity firm focused on digital infrastructure assets such as data centers. The Japanese conglomerate aims to capitalize on the burgeoning demand for computing power essential for artificial intelligence applications.

The potential transaction could see New York-listed DigitalBridge being taken private. News of these talks prompted a significant surge in DigitalBridge's stock, which rose 45% in a single trading session, reflecting strong investor optimism about the deal.

While SoftBank has a history of acquisitions in asset management, including Fortress Investment Group, this move aligns with its broader strategy, such as the Stargate data center project. The acquisition is seen as a strategic step to bolster its position in the rapidly expanding digital infrastructure market.