Home / Business and Economy / Silver Surges: Citi Predicts $150 Price Spike

Silver Surges: Citi Predicts $150 Price Spike

28 Jan

Summary

- Citigroup forecasts spot silver prices could reach $150 per ounce.

- Chinese buying momentum is expected to sustain silver's upward trend.

- Silver prices saw their best January in decades, nearing gold's performance.

Citigroup analysts predict that spot silver prices could ascend to $150 per ounce in the upcoming three months. This forecast stems from the belief that Chinese buying momentum will persist, necessitating elevated price levels to prompt current holders to divest. Silver has demonstrated exceptional performance recently, achieving its best calendar year in decades in 2025 and experiencing a nearly 50% surge in January alone.

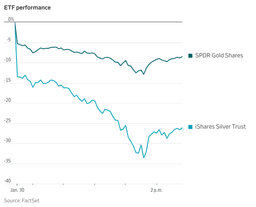

Analysts describe silver's current behavior as akin to 'gold squared,' suggesting the trend will continue until silver appears expensive relative to gold by historical standards. The metal's rapid gains have driven substantial activity in exchange-traded funds, with the iShares Silver Trust ETF seeing nearly $40 billion in turnover recently. This rally is further bolstered by strong physical demand, speculative interest, and a weakening US Dollar, which recently hit a four-year low.