Home / Business and Economy / Silver Surge: Retail Investors Drive Record Commodity Trade

Silver Surge: Retail Investors Drive Record Commodity Trade

16 Jan

Summary

- Individual investors poured $921.8 million into silver ETFs last month.

- Silver prices have climbed 31.3% year-to-date and 210.9% annually.

- The current rally shows structural accumulation, surpassing 2021's 'Silver Spike'.

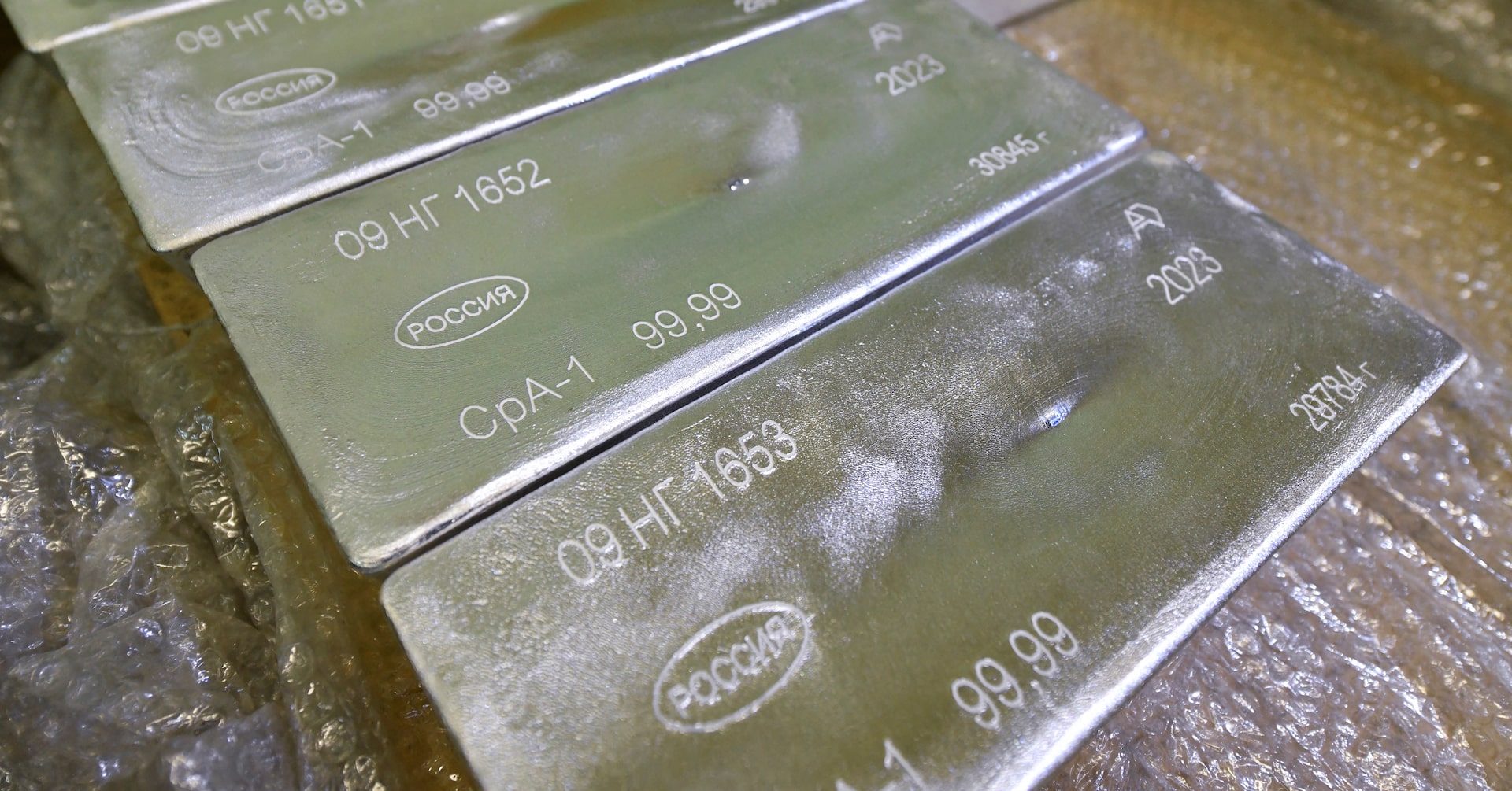

Individual investors have significantly increased their stake in silver, positioning it as the most popular commodity trade. Over the last 30 days, retail investors have purchased approximately $921.8 million in silver-backed exchange-traded funds. This marks a substantial accumulation, with inflows on a recent Wednesday being the second largest day for retail buying, surpassed only by 2021.

The price of silver has responded dramatically, with a 31.3% increase year-to-date and a staggering 210.9% rise in the past year. Silver mining company stocks, tracked by the MSCI ACWI Select Silver Miners Investable Index, have also seen a remarkable surge of around 225% over the last 12 months.

Unlike the 2021 rally, which was linked to meme stocks, current analysis suggests a more fundamental "structural accumulation." This trend indicates silver is evolving from a speculative bet into a core macro trading asset, attracting consistent interest from individual investors.