Home / Business and Economy / New Securities Bill: Market Disclosures Set for Overhaul

New Securities Bill: Market Disclosures Set for Overhaul

21 Dec, 2025

Summary

- Companies must disclose regulatory notices immediately upon receipt.

- Ombudsman system may increase caseload for Securities Appellate Tribunal.

- Bill consolidates existing securities laws into a single framework.

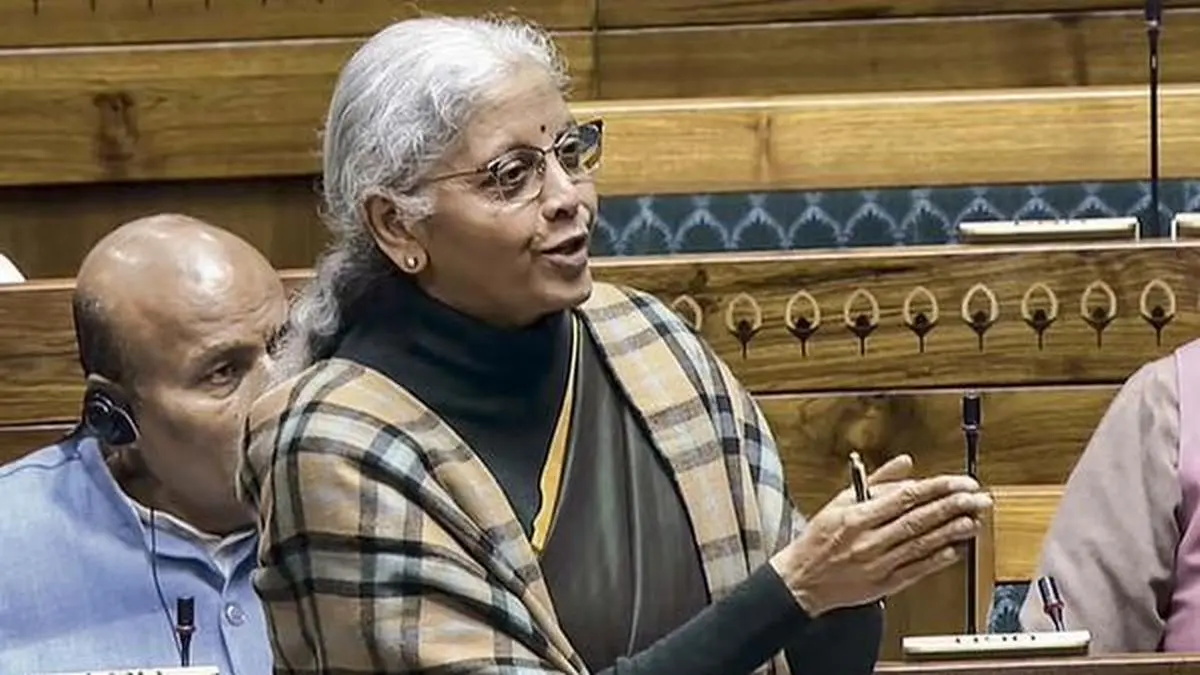

The proposed Securities Market Code Bill, introduced in the Lok Sabha, aims to consolidate and amend existing securities laws into a single framework. This legislation is expected to significantly alter market disclosure requirements for listed companies, mandating immediate reporting of regulatory notices. Such immediate disclosures could lead to unusual stock movements, impacting market dynamics.

The bill also establishes an Ombudsman system to handle investor grievances in a time-bound manner, operating alongside existing platforms. However, this new mechanism raises concerns about overburdening the Securities Appellate Tribunal (SAT), which currently faces a significant caseload. Appeals against the Ombudsman's decisions will exclusively go to SAT, potentially exacerbating pendency issues.

Furthermore, the proposed law introduces a statutory cap on SEBI's inspection and investigation powers, limiting them to eight years except in cases with systemic impact. Investigations will also be time-bound, completing within 180 days. Separately, SEBI is required to set up a Reserve Fund from its surplus.