Home / Business and Economy / NXP Semiconductors Surges on Analyst Upgrade and Q3 Beat

NXP Semiconductors Surges on Analyst Upgrade and Q3 Beat

12 Nov

Summary

- JP Morgan analyst raises NXP's price target to $245

- NXP reports Q3 revenue exceeding guidance by $23M

- Company expects 6% YoY and 4% sequential growth in Q4

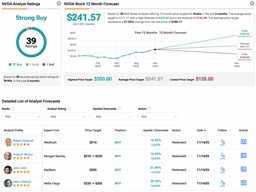

As of November 12, 2025, NXP Semiconductors N.V. (NASDAQ:NXPI) has emerged as a standout performer in the semiconductor industry. On October 29, 2025, Harlan Sur, an analyst at JP Morgan, increased the price target on NXP Semiconductors to $245 from $240, while reaffirming a 'Neutral' rating on the stock. This revision suggests a potential upside of nearly 23% from the current price level.

Earlier on October 27, 2025, NXP Semiconductors reported its third-quarter results, showcasing a strong performance. The company's revenue surpassed guidance by $23 million, as stated by Rafael Sotomayor, the President of NXP. "We maintained good profitability and controlled operating expenses, resulting in healthy fall-through," Sotomayor noted.

Looking ahead, NXP Semiconductors is engaged in various strategic initiatives that management believes will yield meaningful returns from 2028 onwards. The company anticipates fourth-quarter revenue to reach $3.3 billion, reflecting a 6% year-over-year and 4% sequential growth, driven by its automotive, mobile, and Industrial and IoT businesses.