Home / Business and Economy / Nvidia's AI Dominance Soars: Analyst Boosts Price Target by 39%

Nvidia's AI Dominance Soars: Analyst Boosts Price Target by 39%

17 Nov

Summary

- Analyst raises Nvidia's price target to $265, up 39.3% from $220

- Nvidia's long-term growth in AI-driven data center space is optimistic

- Analyst projects Nvidia's 2027 EPS could climb above $9

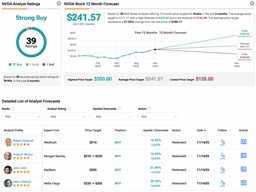

On November 17, 2025, Wells Fargo analyst Aaron Rakers has raised his price target on Nvidia (NVDA) stock to $265, up 39.3% from the previous $220 target. Rakers has maintained a Buy rating on the chipmaker ahead of Nvidia's fiscal Q3 earnings report.

The analyst is highly optimistic about Nvidia's long-term growth prospects, particularly in the AI-driven data center space. Rakers has made only slight adjustments to near-term estimates, but has significantly raised projections for Fiscal 2027 and Fiscal 2028. This move comes as major cloud providers ramp up investments in AI infrastructure.

The key reason for Rakers' optimism is Nvidia's ability to scale up supply and maintain strong visibility into demand through 2026 and beyond. The analyst suggests Nvidia's 2027 earnings per share (EPS) could climb above $9, slightly higher than the current forecast of $8.90.

Rakers' updated $265 price target is based on a 30x price-to-earnings (P/E) multiple on Nvidia's calendar year 2027 earnings, reflecting the company's "best-in-class positioning" in the ongoing AI and data center investment cycle.