Home / Business and Economy / Small Reactors, Big Bets: Nuclear's Comeback

Small Reactors, Big Bets: Nuclear's Comeback

11 Jan

Summary

- Nuclear startups raised $1.1 billion in late 2025 for small reactor development.

- Manufacturing challenges include supply chain gaps and a loss of industrial expertise.

- Investor optimism is high, but scaling mass production may take a decade.

Nuclear energy is undergoing a significant revival, marked by refurbished old plants and substantial investments in innovative startups. In the final weeks of 2025 alone, these ventures secured $1.1 billion, driven by the potential of smaller, more agile reactor designs. This new wave contrasts sharply with the costly and delayed construction of traditional, large-scale reactors, such as the Vogtle 3 and 4 units in Georgia.

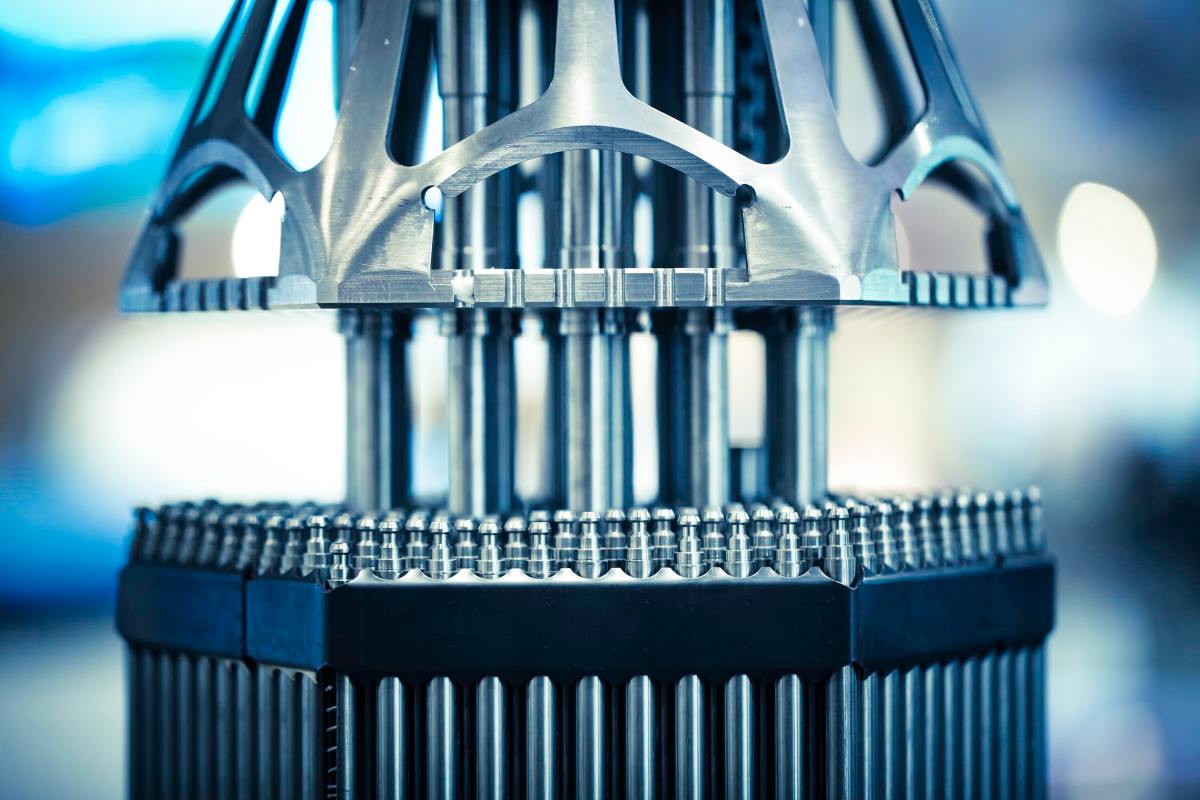

Startups are betting that miniaturized reactors can be mass-produced, drawing parallels to the automotive industry's manufacturing efficiencies. This approach aims to reduce costs through scaled production, a benefit experts are still quantifying. However, significant challenges persist. The U.S. faces a critical shortage of domestic manufacturing capabilities, with key materials needing to be sourced overseas and a diminished industrial workforce lacking decades of experience in factory construction and operation.

Despite these manufacturing and human capital obstacles, capital is currently abundant for nuclear ventures. Many startups are prioritizing modular designs and co-locating production near technical teams to facilitate iterative improvements. While investor enthusiasm is palpable, the full realization of mass manufacturing benefits, including projected cost reductions, is anticipated to unfold over the next decade, requiring sustained effort and strategic development.