Home / Business and Economy / Nokia Stock Soars on AI Hopes & Analyst Upgrades

Nokia Stock Soars on AI Hopes & Analyst Upgrades

25 Nov, 2025

Summary

- Nokia's stock price target increased from €5.29 to €5.39.

- Analysts highlight AI opportunities and strong quarterly results.

- Danske Bank and SEB Equities upgraded Nokia to 'Buy'.

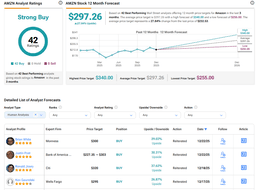

Nokia Oyj is experiencing a positive shift in analyst sentiment, evidenced by a modest increase in its consensus price target to €5.39 per share. This upward revision is fueled by anticipation of significant revenue growth, particularly from emerging AI-driven opportunities. Analysts are increasingly optimistic, pointing to the company's solid performance in its key business segments.

Several financial institutions have recently upgraded their ratings for Nokia. Danske Bank upgraded the stock to 'Buy' with a €6.50 price target, labeling Nokia a "compelling AI-linked equity for years to come." Similarly, SEB Equities initiated a 'Buy' rating with a €6 target. Price target increases from UBS, JPMorgan, and Raymond James further underscore this bullish outlook.

These positive assessments are largely attributed to stronger-than-expected third-quarter results, the company's strategic focus on networking infrastructure, and its potential to leverage artificial intelligence. BNP Paribas Exane upgraded Nokia to 'Outperform,' suggesting that previous concerns might have been overstated and highlighting the company's evolving business model.