Home / Business and Economy / Netflix-WBD Merger: APAC Revenue Powerhouse?

Netflix-WBD Merger: APAC Revenue Powerhouse?

8 Dec, 2025

Summary

- Merged Netflix and WBD could generate $6.6B in APAC revenue annually.

- WBD's streaming in Asia is nascent, with SVOD deals ending in 2027.

- The $82.7B deal faces regulatory hurdles and a potential $5.8B breakup fee.

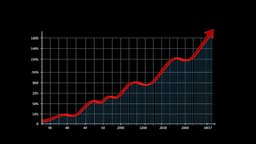

A proposed merger between Netflix and Warner Bros. Discovery (WBD) is poised to create a formidable force in the Asia-Pacific media market, potentially generating annual revenues of $6.6 billion. Media Partners Asia reports that Netflix's current APAC revenue stands at approximately $5.5 billion, with WBD contributing an additional $1.1 billion. While Netflix's presence is primarily subscription-based, WBD also operates as a significant content distributor and has a less developed streaming footprint in the region, outside of Australia.

This consolidation presents a critical strategic juncture for the merged entity. Key decisions will revolve around whether to renew WBD's existing subscription video-on-demand (SVOD) deals in markets such as India, Japan, and Korea, or to consolidate this content onto their proprietary platforms. These current licensing agreements are in place until 2027, offering a window for strategic planning. Competitors may respond by seeking deeper alliances with other major players like NBCUniversal, Sony, and Disney.