Home / Business and Economy / Netflix's Bold Bet: Will Warner Bros. Fuel Future Dominance?

Netflix's Bold Bet: Will Warner Bros. Fuel Future Dominance?

13 Dec

Summary

- Netflix announced plans to acquire Warner Bros. Discovery for $82.7 billion.

- Investor reaction was negative, with the stock declining after the acquisition news.

- Analysts predict Netflix can outperform the S&P 500 from 2026 to 2030 regardless of the deal.

Netflix recently announced its intention to acquire Warner Bros. Discovery for $82.7 billion, a move that has seen a negative reaction from investors, with its stock price falling. This potential acquisition faces further complications due to a hostile takeover bid from Paramount Skydance.

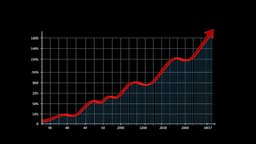

Despite the uncertainty surrounding the Warner Bros. deal, Netflix's financial standing remains robust. The company possesses a strong balance sheet and has demonstrated consistent profitability. Its core business, built on original content and efficient distribution, is considered a well-oiled machine capable of sustained subscriber growth and revenue increases.

Analysts believe Netflix is well-positioned to outperform the S&P 500 between 2026 and 2030. This prediction holds true whether the Warner Bros. acquisition is finalized or not, highlighting the company's intrinsic value and strong market position.