Home / Business and Economy / Micron Stock Poised for Big Move on Earnings

Micron Stock Poised for Big Move on Earnings

16 Dec, 2025

Summary

- Analysts project record sales and double earnings for Micron.

- Micron's stock could see a 9% swing by week's end.

- Strong AI demand has nearly tripled Micron's stock value this year.

Micron Technology is poised to announce its fiscal first-quarter earnings, with market watchers expecting robust sales and profit growth. Analysts forecast a substantial year-over-year jump in revenue to a record $12.93 billion and a more than doubling of adjusted earnings per share to $3.96. This anticipates a strong performance driven by the burgeoning artificial intelligence sector.

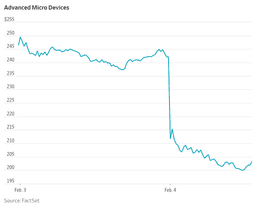

The memory chip maker, which supplies crucial components to AI leaders such as Nvidia and Advanced Micro Devices, has experienced remarkable growth this year. Strong demand for its memory chips has led to a near tripling of its stock value in 2025, positioning it as a top performer in the S&P 500 and a significant beneficiary of the AI boom.

Options trading indicates a potential for a significant market reaction, with traders anticipating a stock movement of up to 9% in either direction following the earnings report. This volatility reflects investor anticipation of Micron's continued success in the high-demand AI market, especially as it strategically shifts focus to more profitable AI-centric products.