Home / Business and Economy / Burry Bets Big on GameStop for 50 Years

Burry Bets Big on GameStop for 50 Years

27 Jan

Summary

- Burry sees GameStop trading near tangible book value.

- He believes Ryan Cohen will deploy company capital for growth.

- Burry views the investment as a long-term, asymmetric bet.

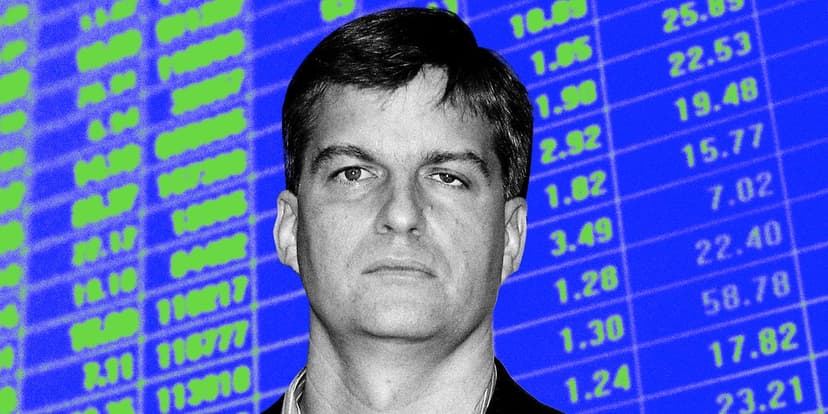

Michael Burry, renowned for his role in 'The Big Short,' has announced he is accumulating shares of GameStop, a prominent meme stock. He disclosed this investment strategy on his Substack, Cassandra Unchained.

Burry's investment is characterized as a long-term play, with him anticipating GameStop's stock to trade at approximately one times its tangible book value. He expressed confidence in CEO Ryan Cohen's ability to effectively manage and deploy the company's capital and cash flows over an extended period.

While acknowledging the unconventional nature of his investment, Burry highlighted the protected downside due to GameStop's tangible asset value. He stated that this makes the long position in GameStop highly asymmetric within the current U.S. stock market landscape. Burry is not relying on a short squeeze for value realization but rather on the company's fundamental setup, governance, and strategic direction under Cohen.