Home / Business and Economy / Japanese Investors Shift Strategy: Bond Sell-off in December

Japanese Investors Shift Strategy: Bond Sell-off in December

13 Jan

Summary

- Japanese investors sold foreign bonds and equities in December.

- Total foreign bond investment by Japanese investors reached 13.59 trillion yen in 2025.

- Concerns over the fiscal outlook led to significant British bond sales in November.

Japanese investors were net sellers of foreign debt and equities during December. This move occurred as U.S. Treasury yields climbed, influencing decisions to divest from bonds. Simultaneously, elevated stock valuations encouraged profit-taking, leading to significant sales of foreign equities. These actions marked a reversal from prior investment trends.

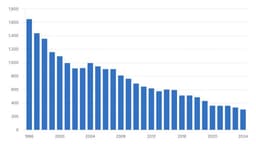

Despite the net selling observed in December, Japanese investors demonstrated a substantial commitment to foreign bonds throughout 2025, collectively investing approximately 13.59 trillion yen. This figure represents a threefold increase compared to the previous year. Similarly, foreign equities saw net purchases totaling 1.71 trillion yen in 2025, ending a two-year period of divestment.

Specific sectors contributed to the December outflows, with life insurers leading the sale of foreign long-term bonds. Concerns regarding fiscal outlook also impacted holdings, notably leading to the sale of 342.67 billion yen worth of British bonds in November. In contrast, U.S. bonds attracted significant inflows, with 10.6 trillion yen invested last year.