Home / Business and Economy / Rising Rates Push Japanese Firms to Convertible Bonds

Rising Rates Push Japanese Firms to Convertible Bonds

10 Feb

Summary

- Japanese companies increasingly use convertible bonds due to rising debt costs.

- Convertible bonds offer lower borrowing costs but may dilute existing shareholders.

- Stock market volatility in Japan is a key concern for issuing convertible bonds.

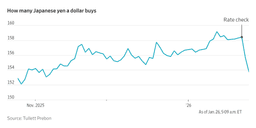

Japanese corporations are turning to convertible bonds amid rising interest rates and increased stock valuations. The benchmark 10-year bond yield reached 2.38% in January, a level not seen since 1999, making traditional debt instruments more costly. Investment bankers anticipate a significant surge in convertible bond issuance in 2026, with expectations of around ¥1 trillion ($6.4 billion) in proceeds.

Convertible bonds, which can be exchanged for stock, offer issuers lower borrowing costs, often with zero coupons to reduce interest payments. Last year, Japanese companies raised ¥283 billion through these instruments, a figure that neared ¥969 billion in 2024. However, the primary obstacle to wider adoption is the increased volatility in Japanese stocks, which heightens the risk of shareholder dilution.