Home / Business and Economy / Rising Rates Push Japanese Firms to Convertible Bonds

Rising Rates Push Japanese Firms to Convertible Bonds

10 Feb

Summary

- Japanese companies increasingly use convertible bonds due to rising debt costs.

- Convertible bonds offer lower borrowing costs but may dilute existing shareholders.

- Stock market volatility in Japan is a key concern for issuing convertible bonds.

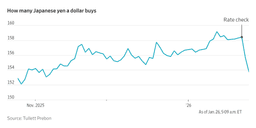

Japanese corporations are turning to convertible bonds amid rising interest rates and increased stock valuations. The benchmark 10-year bond yield reached 2.38% in January, a level not seen since 1999, making traditional debt instruments more costly. Investment bankers anticipate a significant surge in convertible bond issuance in 2026, with expectations of around ¥1 trillion ($6.4 billion) in proceeds.

Convertible bonds, which can be exchanged for stock, offer issuers lower borrowing costs, often with zero coupons to reduce interest payments. Last year, Japanese companies raised ¥283 billion through these instruments, a figure that neared ¥969 billion in 2024. However, the primary obstacle to wider adoption is the increased volatility in Japanese stocks, which heightens the risk of shareholder dilution.

The volatility gauge for the Nikkei 225 index recently reached a 10-month high of 39.03, surpassing gauges for Hong Kong and the S&P 500. This jittery market environment, compounded by global economic uncertainty and local political developments, makes it difficult for companies to consider convertible bond financing due to potential dilution concerns. Flexibility in financing methods becomes crucial as geopolitical risks grow, with options potentially narrowing if market conditions worsen.