Home / Business and Economy / IREN Stock Plummets: AI Sentiment Slump or Buy Signal?

IREN Stock Plummets: AI Sentiment Slump or Buy Signal?

17 Dec

Summary

- IREN stock dropped 47% from its 52-week high, underperforming peers.

- Analysts see volatility as sentiment-driven, not a fundamental break.

- Significant capital is planned for GPU expansion, with funding in progress.

IREN's stock has seen a sharp 47% decrease from its peak, significantly underperforming competitors in the mining and high-performance computing (HPC) sectors. Investment bank B. Riley has reiterated its buy rating and price target, attributing the stock's volatility to sentiment rather than a fundamental breakdown. Analysts point to the stock's tendency to overshoot in both directions, suggesting current AI-driven drawdowns could be opportune entry points for investors comfortable with market swings.

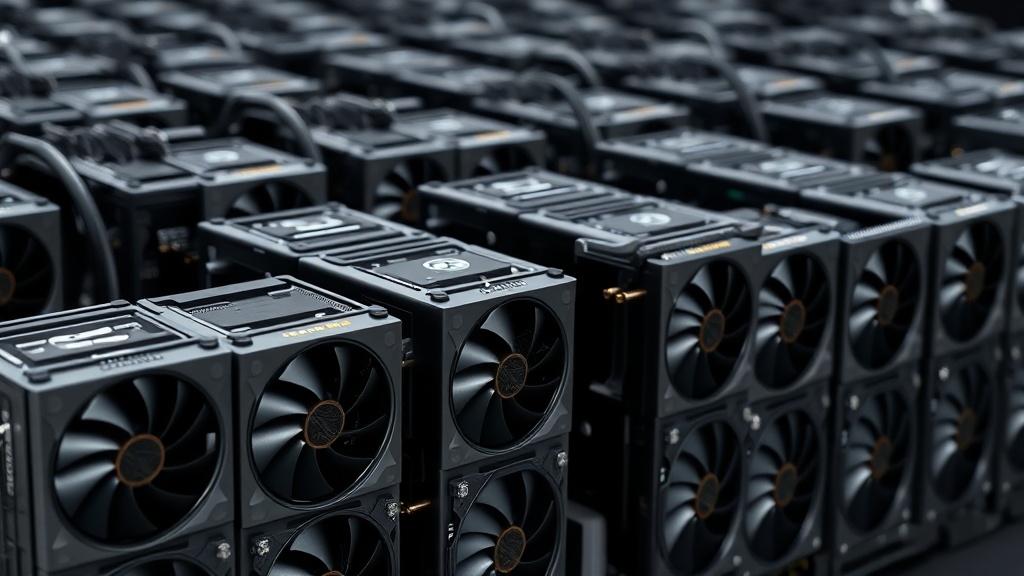

The company faces a substantial capital requirement for its planned HPC expansion, with an estimated $11.6 billion in capital expenditure for thousands of GPUs across multiple campuses. B. Riley's report indicates that approximately $8.85 billion in capital is already lined up, including significant prepayments from Microsoft and financing for upcoming GPU procurements, alongside existing cash reserves.

Recent financial maneuvers, including the issuance of convertible senior notes and the repurchase of older notes, aim to bolster IREN's capital structure. B. Riley characterizes the recent stock pullback as a response to weak AI sentiment in a cyclical market, emphasizing that it does not reflect a structural issue with Microsoft-centric GPU build-outs. The bank advises accumulating IREN shares ahead of a potential resurgence in AI enthusiasm and continued progress in its HPC expansion.