Home / Business and Economy / IREN Stock Plummets: AI Sentiment Slump or Buy Signal?

IREN Stock Plummets: AI Sentiment Slump or Buy Signal?

17 Dec

Summary

- IREN stock dropped 47% from its 52-week high, underperforming peers.

- Analysts see volatility as sentiment-driven, not a fundamental break.

- Significant capital is planned for GPU expansion, with funding in progress.

IREN's stock has seen a sharp 47% decrease from its peak, significantly underperforming competitors in the mining and high-performance computing (HPC) sectors. Investment bank B. Riley has reiterated its buy rating and price target, attributing the stock's volatility to sentiment rather than a fundamental breakdown. Analysts point to the stock's tendency to overshoot in both directions, suggesting current AI-driven drawdowns could be opportune entry points for investors comfortable with market swings.

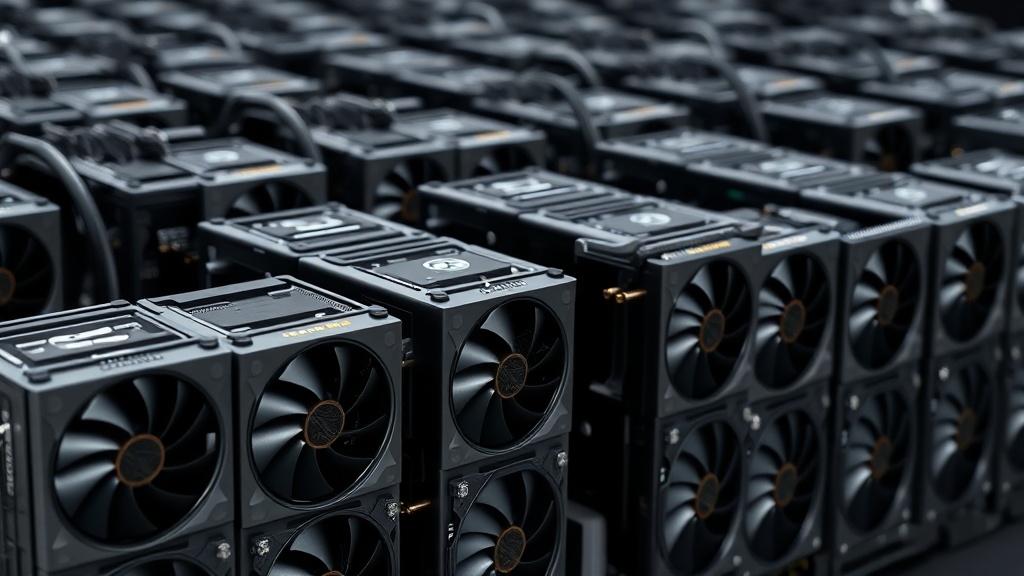

The company faces a substantial capital requirement for its planned HPC expansion, with an estimated $11.6 billion in capital expenditure for thousands of GPUs across multiple campuses. B. Riley's report indicates that approximately $8.85 billion in capital is already lined up, including significant prepayments from Microsoft and financing for upcoming GPU procurements, alongside existing cash reserves.