Home / Business and Economy / Intel's Weak Forecast Sparks Investor Concern

Intel's Weak Forecast Sparks Investor Concern

23 Jan

Summary

- Intel's current quarter revenue forecast missed analyst expectations.

- Supply shortages and manufacturing yields are hindering Intel's recovery.

- The company's stock declined following the release of its financial outlook.

Intel Corporation has issued a disappointing financial forecast for the current quarter, citing ongoing supply shortages that impede its ability to satisfy customer demand. The projected revenue range of $11.7 billion to $12.7 billion fell below the $12.6 billion anticipated by Wall Street analysts.

This setback comes as Intel struggles with manufacturing yields, a critical factor in its ongoing efforts to regain technological leadership. The company's stock saw a decrease of approximately 3% in extended trading on Thursday after the report was issued.

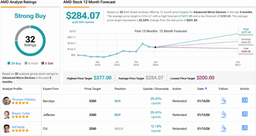

Despite recent enthusiasm from investors and high-profile investments, including from the U.S. government and Nvidia, Intel faces significant execution challenges. The company's annual revenue of $53 billion last year was substantially below its 2021 peak. Intel is currently competing fiercely with rivals like AMD and Qualcomm in the race for AI-capable personal computers.

CEO Lip-Bu Tan acknowledged the strong demand but admitted that manufacturing yields are not meeting his standards. He stressed the team's laser focus on improving execution to overcome these operational hurdles and restore the company's former prominence in the chip industry.