Home / Business and Economy / Indian Stocks Plunge: Bear Market Grip Tightens

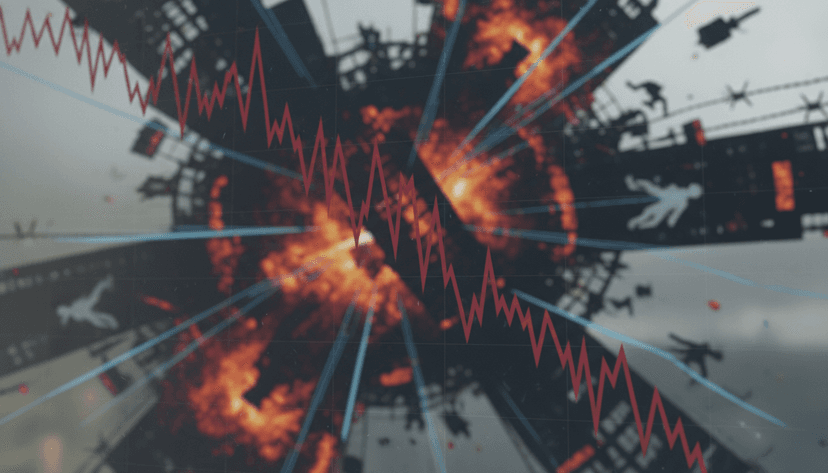

Indian Stocks Plunge: Bear Market Grip Tightens

12 Jan

Summary

- Indian stock market in bear grip for sixth consecutive session.

- Sensex crashed over 500 points; Nifty 50 dropped 0.60%.

- Investor wealth eroded by over ₹16 lakh crore in six sessions.

The Indian stock market remained under significant pressure, entering its sixth consecutive session of decline on Monday, January 12, 2026. This sustained downturn is attributed to escalating geopolitical tensions, worries surrounding US tariffs, and a continuous outflow of foreign capital. The market's broad-based weakness was evident as the Sensex tumbled over 500 points intraday, reaching a low of 83,043, while the Nifty 50 also saw a dip of 0.60%, falling to 25,529 during the trading session.

Over the past six trading days, the cumulative losses for major indices have been substantial. The Sensex has shed more than 2,700 points, marking a decline of over 3%, with the Nifty 50 experiencing a similar erosion of more than 3%. This prolonged sell-off has significantly impacted investor confidence and wealth across the board.

The financial repercussions for investors are stark, with an estimated ₹16 lakh crore in wealth being wiped out during these six sessions. The total market capitalization of firms listed on the BSE has fallen considerably, dropping from over ₹481 lakh crore to approximately ₹465 lakh crore as of January 2, 2026, reflecting the severity of the market downturn.