Home / Business and Economy / India's EMS Sector: Growth Slows, Investors Wary

India's EMS Sector: Growth Slows, Investors Wary

16 Jan

Summary

- Leading EMS firms like Dixon saw over 30% stock drops.

- Kaynes faces transparency concerns despite strong order book.

- PG Electroplast's AC business hit by monsoon and GST changes.

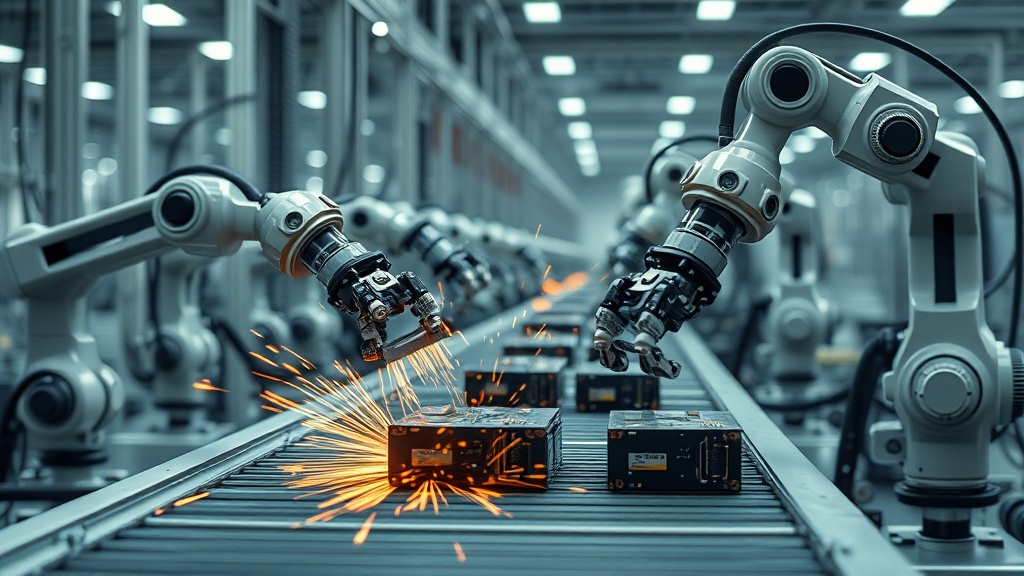

India's electronics manufacturing services (EMS) sector is undergoing a phase of moderated growth after years of expansion. While fundamental demand drivers remain strong, including import substitution and a "China+1" strategy, companies are facing execution challenges and high base effects. This has resulted in a significant stock price correction, with leading firms like Dixon Technologies, Kaynes Technologies, and PG Electroplast experiencing drops of over 30% from their peaks. Investors are now re-evaluating valuations amidst these shifts.

Dixon Technologies reported robust half-year FY26 results with significant revenue and profit growth. However, segment-specific slowdowns, particularly in consumer electronics like LED TVs and washing machines, along with delays in joint venture approvals and concerns over mobile production-linked incentives, have impacted its short-term performance. The company is pivoting towards high-margin component manufacturing and expanding its mobile segment through new joint ventures and a large manufacturing campus.

Kaynes Technologies, transforming into an integrated ESDM company, faces scrutiny over financial reporting transparency and working capital management, despite a strong order book visibility of over three years. PG Electroplast, heavily reliant on the air conditioner market, saw a sharp decline in revenue and profit due to early monsoons and GST changes impacting sales and leading to inventory buildup. Both companies are implementing recovery strategies and diversification efforts to mitigate these challenges.