Home / Business and Economy / Silver Surges Past Gold: Ratio Hits Historic Lows

Silver Surges Past Gold: Ratio Hits Historic Lows

26 Jan

Summary

- Silver price has rallied 200% in the last 12 months.

- The gold-silver ratio dropped from 127 to 50.

- Dual demand for silver as monetary hedge and industrial metal.

The gold-silver ratio has sharply declined, reaching lows not seen in years. In April 2025, 1 kg of gold would have bought approximately 110 kg of silver, a stark contrast to the current 47 kg. This shift indicates a structural repricing of silver relative to gold.

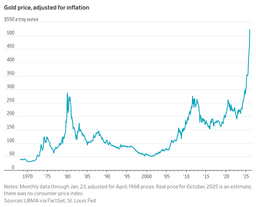

This compression, from a pandemic-era high of 127 to 50 at the start of 2026, is attributed to silver's rapid 200% rally over the last 12 months, eclipsing gold's 80% rise. Analysts suggest such rapid declines often occur in late-stage precious metals bull markets.

Silver's outperformance is fueled by a dual demand surge. It is sought after as a monetary hedge and is critical for industrial applications in solar, electric vehicles, and grid infrastructure. Currently, both gold and silver are trading at record highs.