Home / Business and Economy / Nonprofits Get Fintech Upgrade From Givefront

Nonprofits Get Fintech Upgrade From Givefront

18 Dec

Summary

- Givefront offers fintech tailored for nonprofits' unique needs.

- Startup focuses on spend management and compliance tools.

- Churches show strong adoption due to volunteer treasurers.

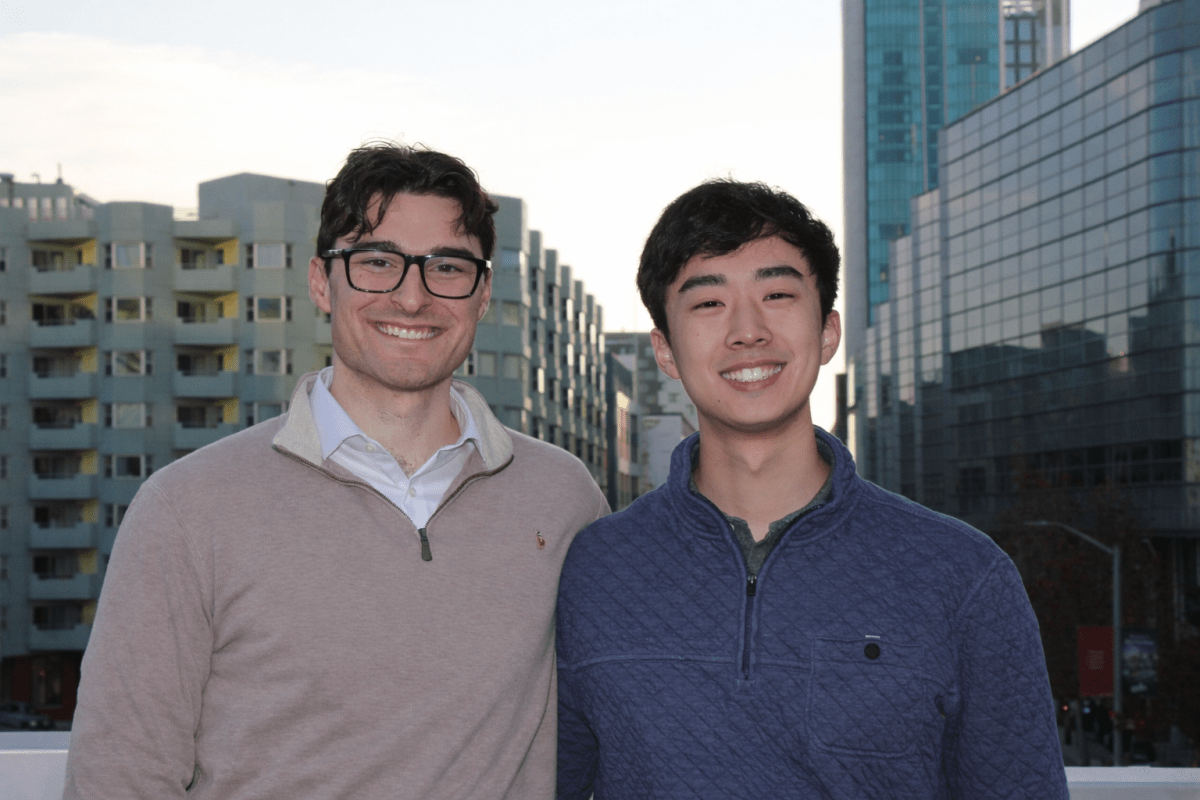

Givefront, a startup supported by Y Combinator, is launching a financial platform specifically designed for the nonprofit sector. Recognizing that organizations like food banks and churches often rely on outdated systems, Givefront aims to provide modern spend management, compliance, and reporting tools. The company's founders, including Harvard dropout Matt Tengtrakool, identified a gap in financial infrastructure for nonprofits, which face stringent reporting requirements.

Initially exploring broader financial services, Givefront pivoted to focus on cards and spend management due to easier adoption rates compared to replacing core accounting software. Their platform integrates with existing legacy systems while adding nonprofit-specific features like grant-based budgeting and automated reporting. This vertical approach offers a significant improvement over generic corporate financial tools.

Since introducing its cards six months ago, Givefront has experienced rapid growth, onboarding hundreds of organizations. The company recently secured $2 million in seed funding to scale its operations and expand its offerings. While the team's youth has been a point of discussion, many religious organizations, often managed by volunteers, have found Givefront's automation particularly beneficial.