Home / Business and Economy / Gilead Sciences Shines as Dividend Champ Amid Biopharma Slump

Gilead Sciences Shines as Dividend Champ Amid Biopharma Slump

17 Nov, 2025

Summary

- Gilead Sciences' shares climb over 36% since 2025

- Oncology revenue falls 3% in Q3, but pipeline remains robust

- Scotiabank analyst sees opportunity in undervalued biopharma stocks

As of November 17, 2025, Gilead Sciences, Inc. (NASDAQ:GILD) has proven to be a standout performer in the biopharma industry. The company's shares have climbed more than 36% since the beginning of 2025, outpacing the broader market. This strong performance is largely attributed to Gilead's status as a dependable dividend payer, a trait that has made it one of the 15 Best Passive Income Stocks to Buy Right Now.

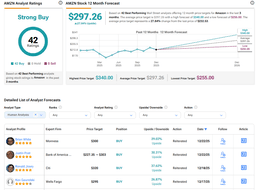

In a recent report, Scotiabank analyst Louise Chen highlighted an "out-of-consensus" positive view on the biopharma sector, noting that years of underperformance in large-cap biopharma stocks could present an attractive entry point before the next wave of innovation. Chen maintained her Outperform rating on Gilead Sciences, recognizing the company's potential.

While Gilead's oncology revenue fell 3% year-over-year to $788 million in the third quarter, the biotech firm continues to lead the HIV drug market, which still drives most of its growth. Total revenue rose 3% from a year earlier to reach $7.8 billion in the same period. Looking ahead, the company is expected to benefit from label expansions and new approvals in the cancer market, which should help drive overall sales higher.