Home / Business and Economy / German Pension Fund Faces $1B Real Estate Loss

German Pension Fund Faces $1B Real Estate Loss

3 Feb

Summary

- BVK faces potential $1 billion loss from US real estate investments.

- Internal probe found compliance violations at BVK, leading to departures.

- Shvo's company claims properties are outperforming market.

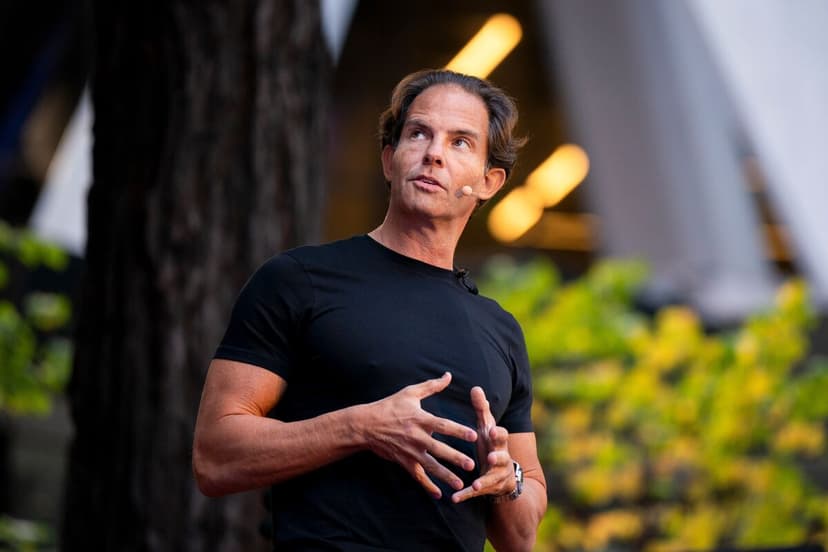

Bavarian pension fund BVK is facing significant potential losses, estimated up to $1 billion, from its US commercial real estate investments made in partnership with developer Michael Shvo and Deutsche Finance Group. This situation has triggered an internal probe at BVK, revealing compliance violations and leading to the exit of two senior managers. Lawmakers in Bavaria are now questioning the approval of these deals.

Despite the financial concerns and ongoing reviews, Shvo's company, Michael Shvo, maintains that its properties are outperforming the market with strong rents. BVK, overseeing €122 billion ($145 billion) in assets, assures clients that their pensions remain secure, with US real estate constituting only a small fraction of its portfolio.

As BVK seeks to divest from Shvo and Deutsche Finance, it reported write-downs of approximately €288 million through the end of November. The firm that coordinated investments, Deutsche Finance Group, is also under scrutiny. The partnership, initiated in 2018, involved billions invested in trophy assets like the Coca-Cola building and the Transamerica Pyramid.