Home / Business and Economy / Energy Stocks: Navigating Decarbonization vs. Demand

Energy Stocks: Navigating Decarbonization vs. Demand

7 Dec

Summary

- Energy sector faces competing forces: decarbonization and economic realities.

- Investors need due diligence for sound energy stock opportunities in 2026.

- Wells Fargo recommends California Resources and Tamboran Resources.

The energy sector, historically driven by oil and gas, is now undergoing significant transformation. Competing pressures from decarbonization initiatives and persistent economic realities like cost, infrastructure, and regional demand are reshaping investment strategies. This dynamic tension is expected to define the sector's evolution through 2026.

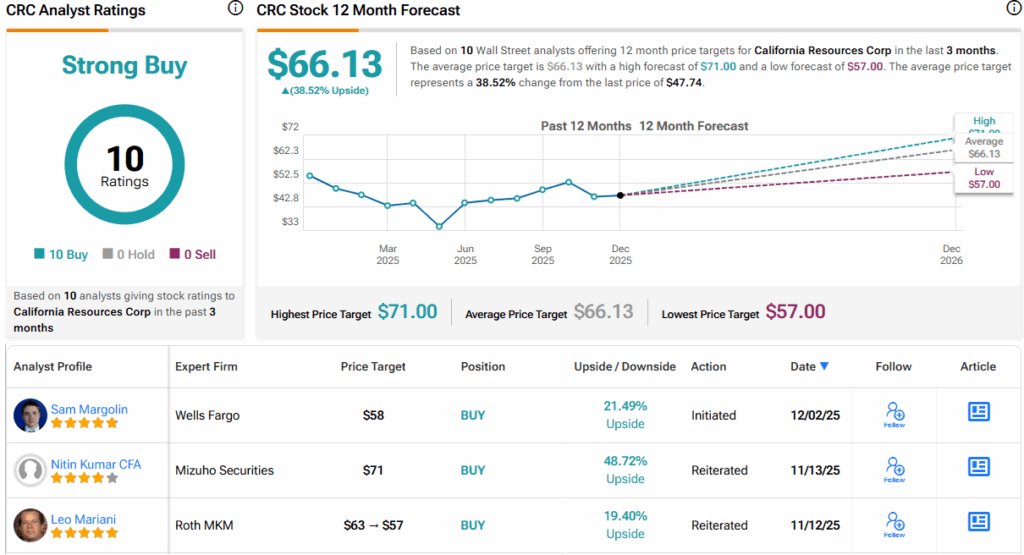

For investors, this complex environment presents both challenges and opportunities. Identifying sound investments requires careful due diligence, focusing on companies with exposure to local supportive factors and upcoming catalysts. Wells Fargo analyst Sam Margolin has identified two such companies, recommending a buy on California Resources and Tamboran Resources.

Margolin cited investor demand for uncorrelated, catalyst-rich stocks. California Resources, with significant mineral rights in California's San Joaquin Basin, and Tamboran Resources, possessing unique assets, are highlighted as potential standouts. Both stocks currently hold Strong Buy consensus ratings, reflecting Wall Street's positive outlook.