Home / Business and Economy / Dollar Dips on Fed Cut Fears and Dovish Chair Speculation

Dollar Dips on Fed Cut Fears and Dovish Chair Speculation

12 Dec, 2025

Summary

- Dollar weakened on expectations of a 25 basis point Federal Reserve rate cut.

- ECB anticipates raising economic growth forecasts, indicating no further rate cuts.

- Japan's producer prices above 2% suggest hawkish policy for the Bank of Japan.

The US dollar experienced a notable decline, with the dollar index falling as anticipation grew for a 25 basis point reduction in the federal funds target range following the Federal Open Market Committee (FOMC) meeting. This downward pressure on the dollar intensified after the US Q3 employment cost index data revealed a slower-than-expected increase, signaling a potentially dovish stance from the Federal Reserve. Concerns also stem from speculation about President Trump potentially appointing a dovish Fed Chair.

Simultaneously, the euro demonstrated strength, with EUR/USD rising amid the broader dollar weakness. Hawkish commentary from the European Central Bank (ECB) further bolstered the euro's performance. ECB President Lagarde hinted at an upward revision of economic growth forecasts for the upcoming policy meeting. Additionally, ECB Governing Council member Simkus stated that current inflation trends suggest no immediate need for interest rate adjustments.

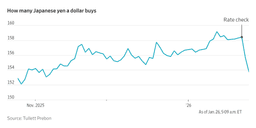

The Japanese yen also saw gains against the dollar, influenced by the weaker US currency and positive domestic economic indicators. Japan's producer price index remaining above 2% last month was interpreted as a hawkish signal for the Bank of Japan's monetary policy. The yen's upward momentum accelerated as Treasury note yields shifted from higher to lower levels during the trading session.