Home / Business and Economy / Deutsche Bank CEO Disses Analyst on US Asset Fears

Deutsche Bank CEO Disses Analyst on US Asset Fears

22 Jan

Summary

- Deutsche Bank CEO contacted US Treasury to disavow analyst report.

- Analyst suggested Europe may sell US assets due to political risks.

- AkademikerPension plans to exit US Treasuries over credit risk concerns.

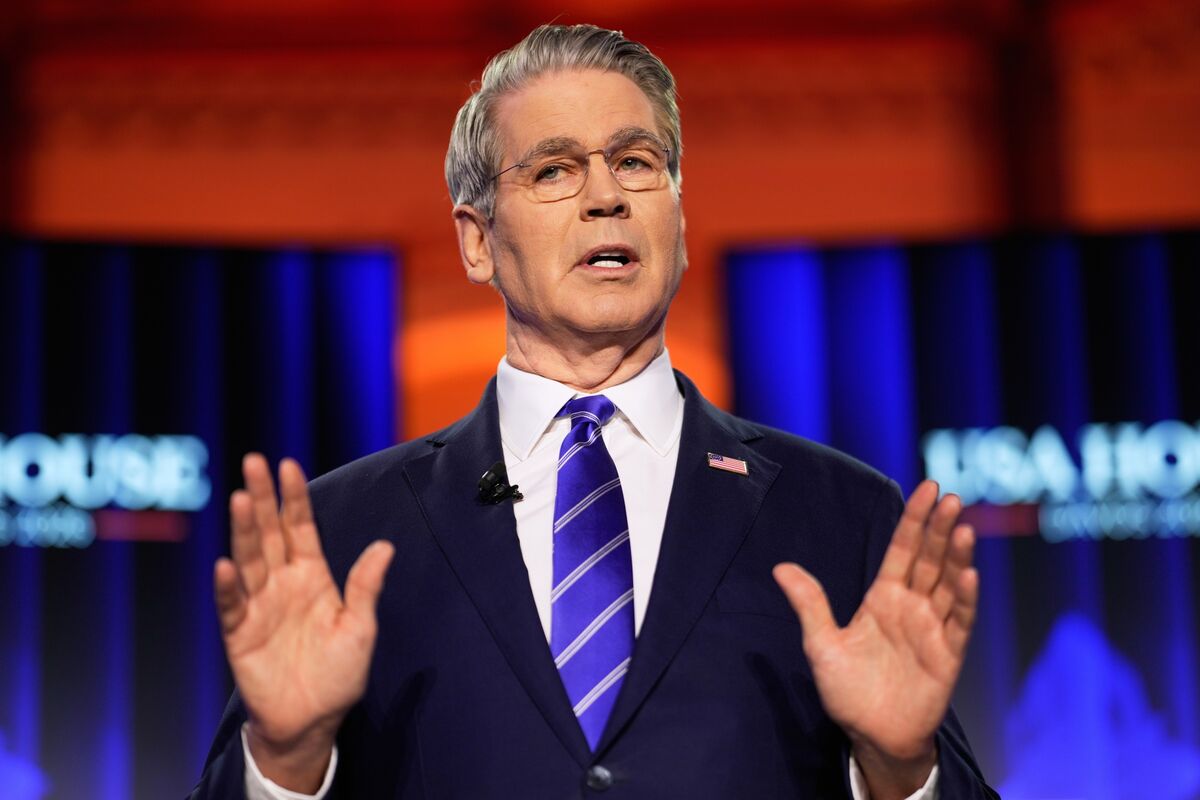

Deutsche Bank CEO Christian Sewing has reportedly contacted US Treasury Secretary Scott Bessent to distance the bank from an analyst's report suggesting a potential sell-off of US assets by European investors. The report, authored by George Saravelos, Global Head of FX Research, indicated that Europe might become less willing to hold US assets due to political developments.

This clarification underscores the significant financial ties between Europe and the US, with European entities holding substantial amounts of US bonds and equities. The analyst's note also pointed to Danish pension funds as early movers in reducing dollar exposure.

Adding to the market's apprehension, Danish pension fund AkademikerPension confirmed it plans to exit its US Treasury holdings by the end of January 2026, citing significant credit risks associated with the current US administration's policies. The fund held approximately $100 million in US Treasuries at the end of 2025.