Home / Business and Economy / Bond Market Cheer Faces Future Bond Sale Storm

Bond Market Cheer Faces Future Bond Sale Storm

14 Dec, 2025

Summary

- US high-grade spreads reached their tightest levels since October.

- Upcoming AI investments and large debt-funded acquisitions loom.

- Strategists predict a rise in bond yields by year-end 2026.

US high-grade corporate bond spreads have tightened considerably, reaching their narrowest point since October. This recent optimism in the market, however, is being questioned by some investors and strategists who foresee potential turbulence ahead. The current low-risk sentiment may not persist into the new year.

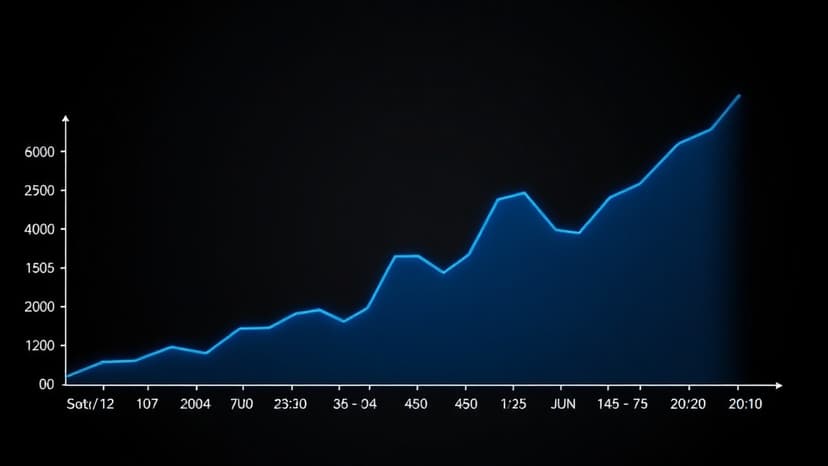

Significant future bond sales are anticipated, driven by substantial investments in artificial intelligence and a series of large, debt-financed acquisitions. Experts estimate US high-grade bond sales could reach approximately $1.6 trillion by 2026, an increase from current levels. These increased offerings could put upward pressure on yields.

Despite the looming supply increase, current market conditions benefit from minimal new bond sales for the remainder of the year, encouraging purchases of existing notes. Additionally, recent Federal Reserve rate cuts have boosted market liquidity. Companies are also generally showing strong earnings performance, contributing to a positive environment for corporate debt.