Home / Business and Economy / Broadcom Surges on Google's Massive AI Capex

Broadcom Surges on Google's Massive AI Capex

5 Feb

Summary

- Google's capital expenditure is projected to nearly double this year.

- This increased spending is driven by artificial intelligence data centers.

- Broadcom benefits as it assists Google in manufacturing custom AI chips.

Broadcom's stock experienced a notable surge of 6% in after-hours trading, directly influenced by Google's recent financial disclosures and significant capital expenditure plans.

Alphabet, Google's parent company, revealed an ambitious projection to spend up to $185 billion on capital expenditures for the current year. This figure represents a substantial increase, nearly doubling the amount invested in the previous year, with a strong focus on developing artificial intelligence infrastructure.

This massive investment in AI data centers is anticipated to provide a significant boost to Broadcom and other technology partners associated with Alphabet. Experts highlight that this substantial capex spend underscores the growing demand for specialized hardware supporting advanced AI workloads.

While Google utilizes industry-standard Nvidia chips, a considerable portion of its AI software, including its advanced Gemini 3 model, operates on its proprietary Tensor Processing Units (TPUs). Broadcom is instrumental in the production of these TPUs through its custom chip business, known as ASICs.

These custom AI chips, or 'XPUs' as Broadcom refers to them, are primarily developed for major tech firms, or 'hyperscalers,' that possess the scale and expertise for specialized AI workloads. Broadcom also supplies Google's TPU Ironwood rack systems to AI lab Anthropic.

Other major technology companies, including Microsoft, Amazon, and Meta, are also investing in their own custom chip development. Broadcom's role as a semiconductor partner is crucial for these hyperscalers, providing essential intellectual property and manufacturing capabilities.

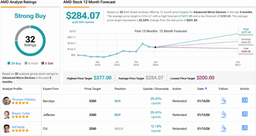

Despite the focus on custom solutions, Google continues to use Nvidia chips, a fact that also contributed to a slight increase in Nvidia's shares. Analysts suggest that the broad investment in AI hardware benefits multiple players within the semiconductor industry.