Home / Business and Economy / BioNTech: Oncology Prowess to Eclipse COVID-19?

BioNTech: Oncology Prowess to Eclipse COVID-19?

19 Jan

Summary

- Goldman Sachs upgrades BioNTech to Buy with a $142 target.

- Analyst highlights BioNTech's expanding oncology and ADC footprint.

- Oncology pipeline expected to drive future stock performance.

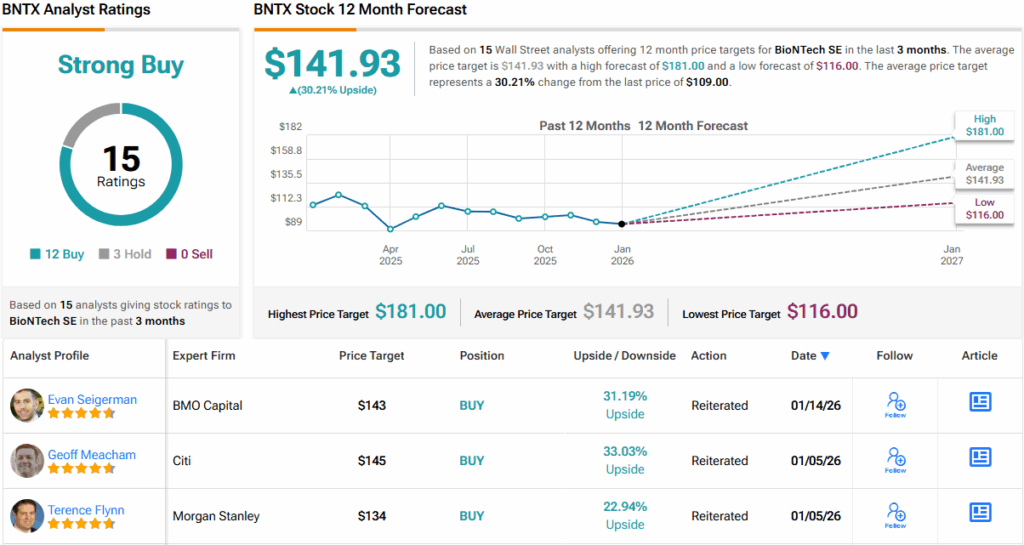

Goldman Sachs analyst Asad Haider has upgraded BioNTech (NASDAQ:BNTX) to a Buy rating, setting a 12-month price target of $142, which suggests a 30% increase from current levels. Haider's bullish outlook stems from BioNTech's strategic positioning in next-generation immuno-oncology and antibody-drug conjugates (ADCs).

The analyst emphasizes that BioNTech's potential lies beyond its COVID-19 vaccine legacy. The company boasts a diversified oncology portfolio, including novel bispecifics and mRNA-based cancer vaccines. This broad approach is expected to reduce dependence on any single trial outcome and drive future value.

While BioNTech shares have faced headwinds partly due to its COVID franchise, Haider anticipates a narrative shift as the company progresses through late-stage development. A series of clinical milestones and expected Phase 2 and Phase 3 data readouts in oncology are projected to create a catalyst-rich period from 2026 onwards.