Home / Business and Economy / Why Clever Bank Risk Tools Fail Supervisors

Why Clever Bank Risk Tools Fail Supervisors

21 Nov, 2025

Summary

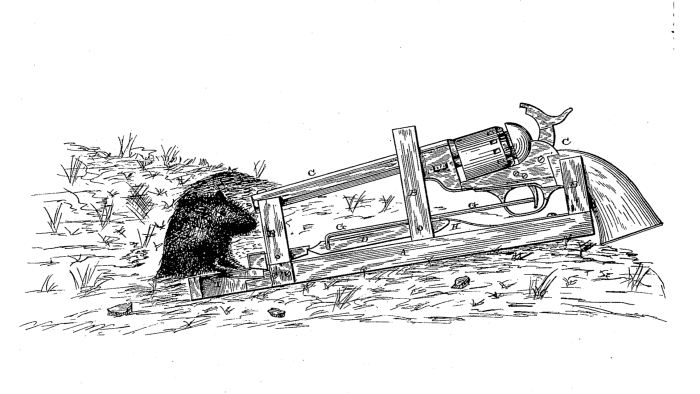

- Regulators use 'mousetrap' models for bank risk, but supervisors often ignore them.

- Economic capital models aim for better bank failure risk assessment.

- Effective bank supervision requires human judgment, not just data models.

Bank regulators frequently develop advanced models, termed 'mousetraps,' designed to provide a more accurate measure of bank failure risk than traditional capital ratios. These models process extensive data to predict potential issues, aiming to offer superior insights. Despite their sophisticated design and the honest motivation behind them, these innovative tools often struggle to be adopted by frontline supervisors.

The core issue lies in the inherent limitations of data-driven approaches. While economic capital models attempt to capture a bank's true value, they often omit crucial elements like fee income and cannot fully substitute for a supervisor's deep understanding of a bank's unique business model and its real-world risks.

Ultimately, the success of these 'mousetrap' models is hindered by a fundamental gap: good supervisors often don't need them, while those who might benefit often lack the inclination or ability to use them effectively. This leads to their widespread neglect, despite the significant effort invested in their creation.