Home / Business and Economy / AMD Price Targets Skyrocket Amid AI Boom

AMD Price Targets Skyrocket Amid AI Boom

21 Jan

Summary

- Multiple financial institutions raised AMD's price targets significantly.

- AMD's AI hardware and data center role is driving positive sentiment.

- The company's Data Center segment revenue increased by 22% year-over-year.

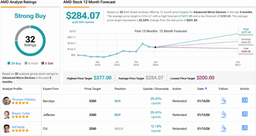

Advanced Micro Devices (AMD) is experiencing a wave of optimism on Wall Street, with numerous financial institutions significantly increasing their price targets. This bullish sentiment is largely attributed to AMD's growing influence in providing hardware for artificial intelligence and data centers, positioning it as a strong competitor in a rapidly expanding market.

Wells Fargo has set a new price target of $345 for AMD shares, maintaining an 'Overweight' rating. This projection suggests a potential upside of approximately 49% from current trading levels. Other firms like UBS, Piper Sandler, KeyBanc, and Morgan Stanley have also updated their targets, reflecting a broad positive outlook.

Analysts are highlighting AMD's strategic advancements in AI, including its 'Helios' platform and a full suite of data center products. Wells Fargo specifically noted AMD's robust position in the server CPU market and its ongoing data center infrastructure expansion. The company's 'full-stack' AI strategy aims to capture significant market share against established players.