Home / Business and Economy / AMD Stock Plummets 17% on Disappointing Earnings

AMD Stock Plummets 17% on Disappointing Earnings

5 Feb

Summary

- Advanced Micro Devices shares fell 17% after earnings missed high expectations.

- Fourth-quarter revenue exceeded forecasts, boosted by China sales.

- Concerns over rising expenses and weak first-quarter guidance impacted stock.

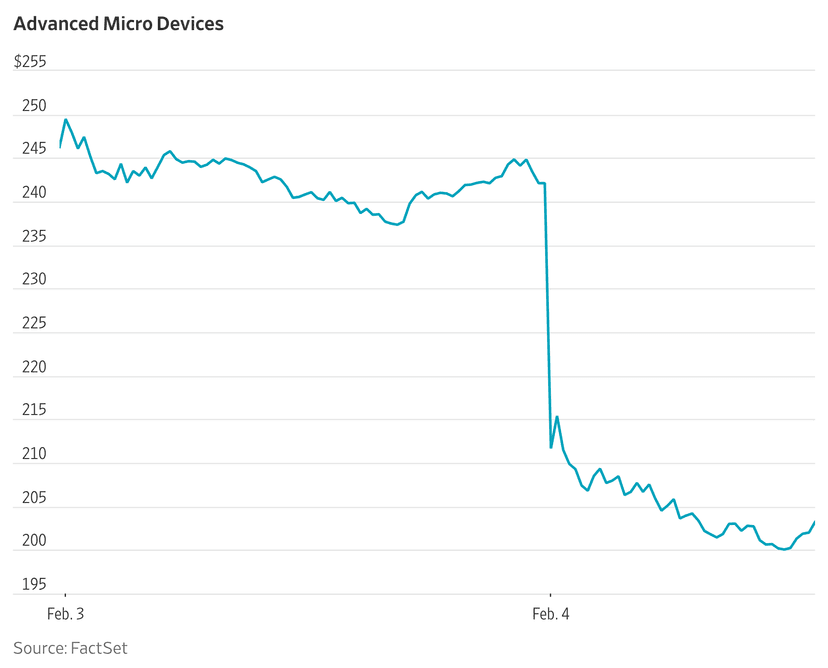

Advanced Micro Devices saw its stock price tumble by 17% on Wednesday, a significant market reaction following its latest earnings report. This represented the largest single-day decrease in the chip manufacturer's stock value since 2017.

The company had previously announced fourth-quarter revenue of $10.27 billion, a figure that surpassed analyst expectations of $9.69 billion. This beat was largely attributed to strong, unexpected chip sales within China.

However, the positive revenue numbers were tempered by several investor concerns. Analysts noted an increase in the company's expenses. Furthermore, AMD's sales forecast for the first quarter of 2026 did not meet the market's elevated expectations, leading to disappointment.

This performance comes amid a broader trend of investor caution towards companies involved in the artificial intelligence sector. The durability of AI-related trade has been a growing concern in recent months, impacting even major competitors like Nvidia.