Home / Business and Economy / AMZN: Analysts Predict 2026 Rebound

AMZN: Analysts Predict 2026 Rebound

2 Jan

Summary

- Analysts see a potential rebound in AWS growth for 2026.

- Amazon's AI infrastructure deals could drive future AWS demand.

- Wall Street analysts maintain a Strong Buy consensus for AMZN stock.

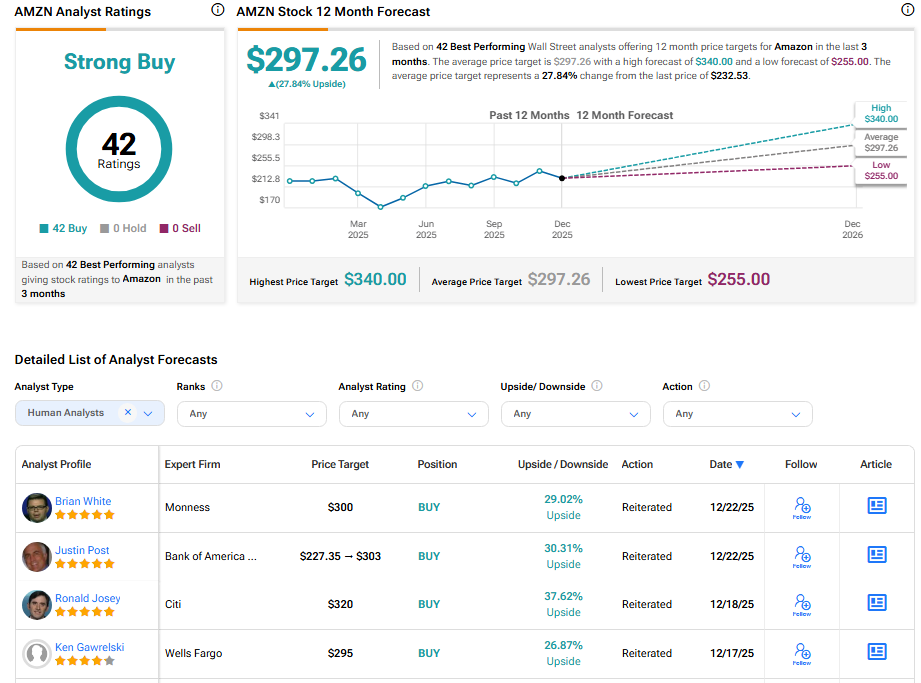

As 2025 concludes, Amazon's stock performance has trailed the broader market, with a modest 6% gain compared to the S&P 500's 18%. This underperformance is attributed to decelerating AWS growth and a longer-than-expected path to profitability from AI investments. However, Wall Street analysts remain largely optimistic about Amazon's long-term trajectory, with many anticipating a setup for improvement into 2026.

Analysts highlight several factors contributing to their positive outlook. Five-star analyst Mark Mahaney has named Amazon a top pick for 2026, expecting a rebound in AWS growth, strong demand for its AI chips, and steady advertising gains. Goldman Sachs and JPMorgan analysts also foresee cloud growth accelerating, driven by AI demand and substantial deals, such as Amazon's $38 billion cloud agreement with OpenAI.

This renewed confidence is reflected in Wall Street's consensus, which shows a Strong Buy rating based on 42 Buy recommendations in the past three months. The average price target of $297.26 suggests a potential 27.8% upside, indicating that analysts believe Amazon's strategic investments in AI and cloud infrastructure are setting the stage for significant future growth and profitability.