Home / Business and Economy / AI Sparks SaaS Stock Selloff: "SaaSpocalypse" Hits Markets

AI Sparks SaaS Stock Selloff: "SaaSpocalypse" Hits Markets

5 Feb

Summary

- AI's perceived threat has triggered the largest stock selloff driven by fear of displacement.

- Software-as-a-service companies are experiencing significant market value erosion.

- Anthropic's AI plug-ins for automating tasks are accelerating investor concerns.

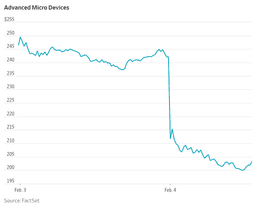

The markets are witnessing the most significant stock selloff driven by fear of AI displacement, with software-as-a-service (SaaS) companies bearing the brunt. This "SaaSpocalypse," which began on February 3rd and continued into February 4th, 2026, has seen the Nasdaq 100 erase over $550 billion in market value.

SaaS companies, which provide internet-accessible applications via recurring subscription fees, are threatened by AI's ability to automate tasks traditionally performed by users. This automation could reduce the need for multiple user licenses, a core revenue stream for SaaS providers. Furthermore, AI is developing tools that can perform tasks like data analysis and report generation, potentially making dedicated SaaS platforms redundant.

Anthropic, a prominent AI developer known for its Claude chatbot and focus on responsible AI development, recently introduced plug-ins designed to automate business tasks. One plug-in, tailored for the legal community to assist with contract review and compliance workflows, has become a symbol of AI's potential to disrupt entire industries and traditional software providers. However, some industry leaders, like Nvidia's CEO Jensen Huang, view the selloff as illogical, arguing AI will enhance rather than replace software products.