Home / Business and Economy / AI Bubble Fears Drive Credit Market Swaps

AI Bubble Fears Drive Credit Market Swaps

4 Jan

Summary

- Investors are increasing hedging against AI-driven tech and utility exposure.

- Credit default swap markets are seeing heightened activity due to AI bubble concerns.

- Trading volumes grow as investors adopt equity-like strategies in fixed income.

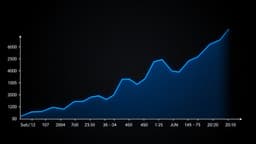

Heightened concerns about a potential AI bubble are prompting investors to increase their hedging activities, particularly within the credit default swap market. This surge in activity is expected to boost trading volumes significantly.

Investors are actively seeking to reduce their exposure to technology companies and utilities that are heavily involved in AI projects. This strategic shift reflects a broader trend of investors becoming more cautious about concentrated risks in their portfolios.

Furthermore, the fixed-income market is experiencing growing trading volumes, with participants adopting innovations long familiar to equity trading. Strategies like portfolio trading and electronic execution are becoming more prevalent, which should help narrow bond spreads by diminishing the illiquidity premium.